Question: 'I)A preferred stock will pay a dividend of Rs.3.00 in the upcoming year and every year hereafter for three years you require a return 9%

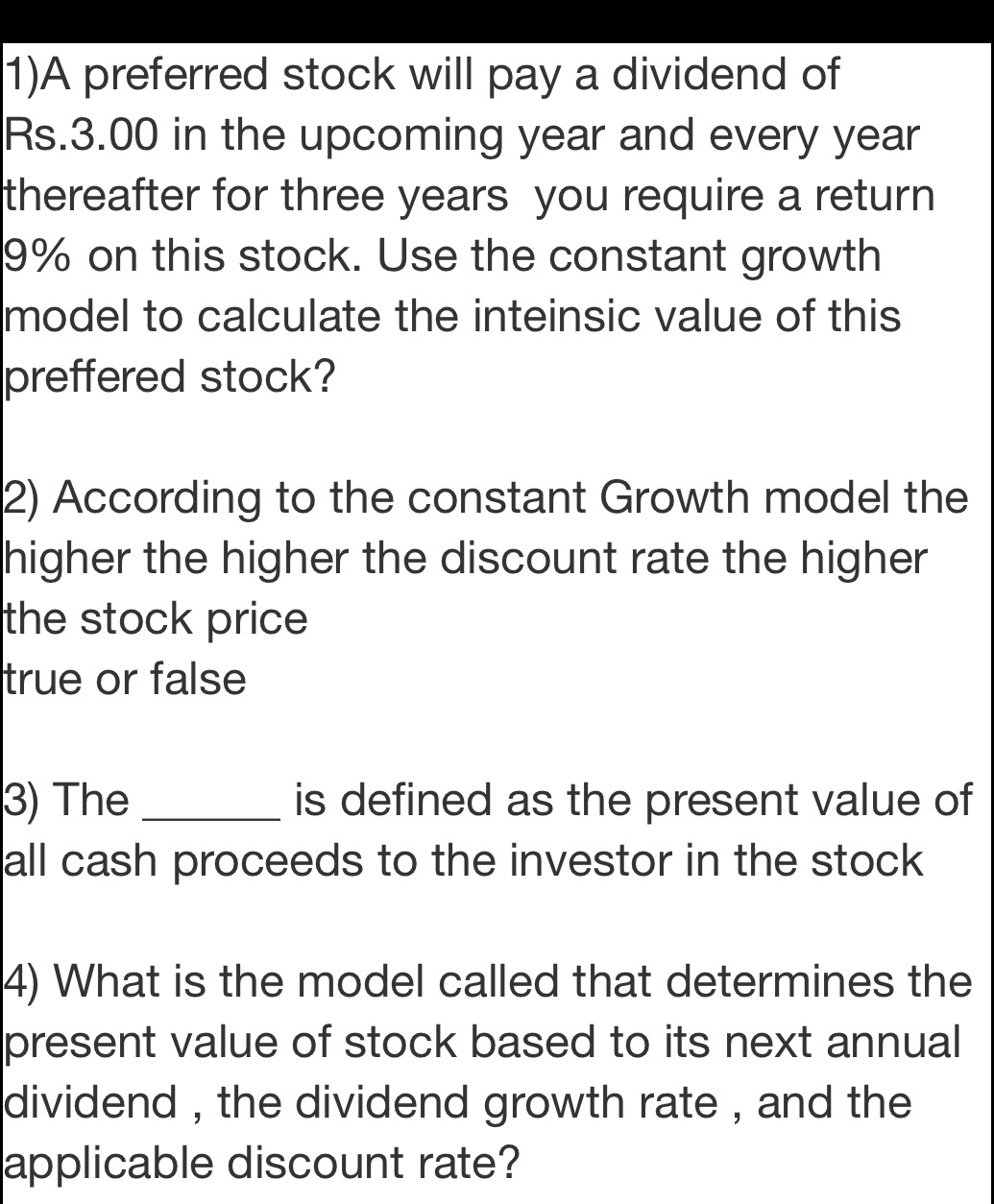

'I)A preferred stock will pay a dividend of Rs.3.00 in the upcoming year and every year hereafter for three years you require a return 9% on this stock. Use the constant growth model to calculate the inteinsic value of this preffered stock? 2) According to the constant Growth model the higher the higher the discount rate the higher he stock price rue or false 3) The is defined as the present value of all cash proceeds to the investor in the stock 4) What is the model called that determines the present value of stock based to its next annual dividend , the dividend growth rate , and the applicable discount rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts