Question: 7. The federal government issues two four-year notes. The first is a traditional type of debt instrument that pays 6 percent annually ($60 per $1,000

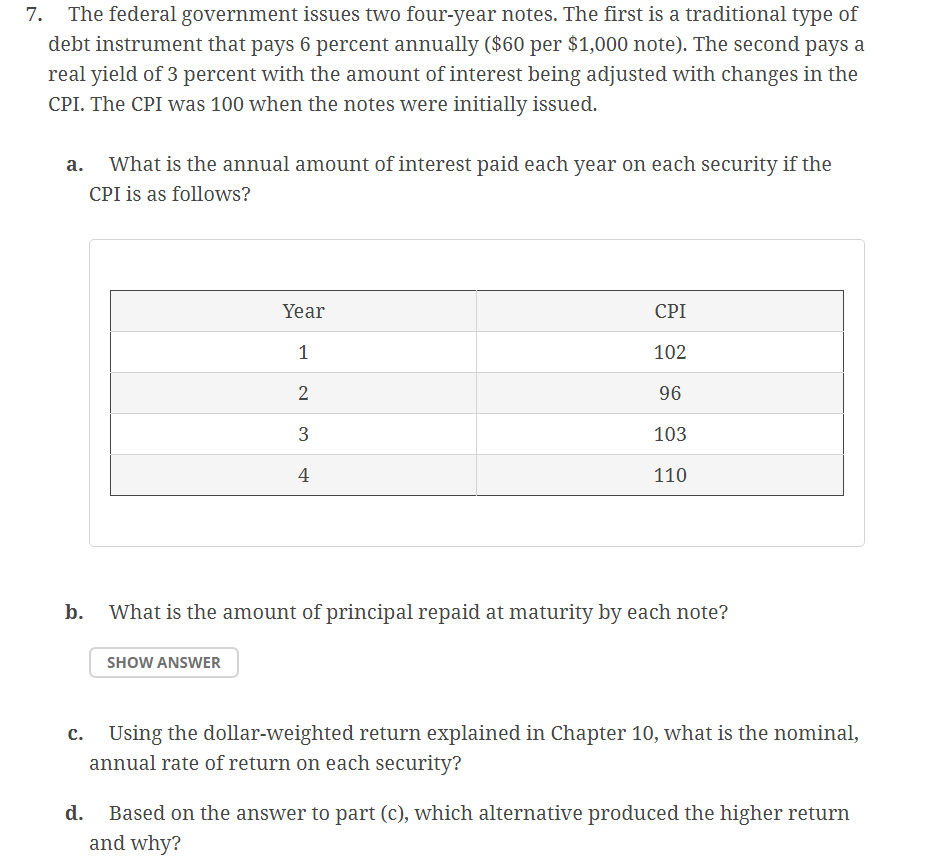

7. The federal government issues two four-year notes. The first is a traditional type of debt instrument that pays 6 percent annually ($60 per $1,000 note). The second pays a real yield of 3 percent with the amount of interest being adjusted with changes in the CPI. The CPI was 100 when the notes were initially issued. a. Whatis the annual amount of interest paid each year on each security if the CPI is as follows? Year CPI 1 102 2 96 3 103 -+ 110 b. Whatis the amount of principal repaid at maturity by each note? SHOW ANSWER c. Using the dollar-weighted return explained in Chapter 10, what is the nominal, annual rate of return on each security? d. Based on the answer to part (), which alternative produced the higher return and why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts