Question: 2. Suppose Company A has learned that Company B (a firm in a different industry but in a business that is strategically attractive to Company

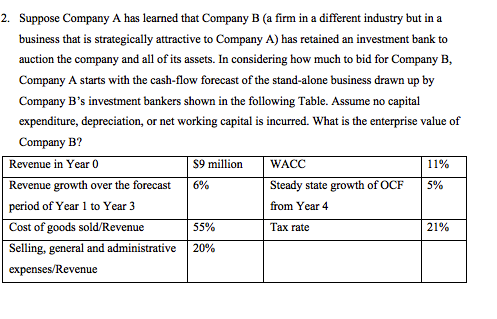

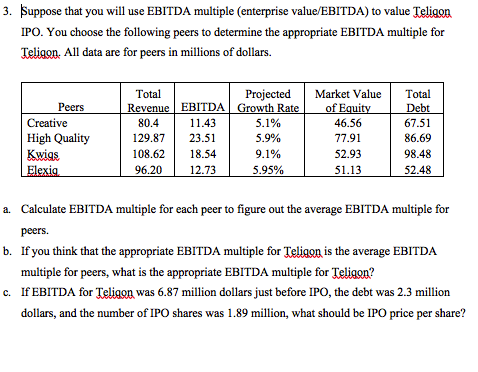

2. Suppose Company A has learned that Company B (a firm in a different industry but in a business that is strategically attractive to Company A) has retained an investment bank to auction the company and all of its assets. In considering how much to bid for Company B, Company A starts with the cash-flow forecast of the stand-alone business drawn up by Company B's investment bankers shown in the following Table. Assume no capital expenditure, depreciation, or net working capital is incurred. What is the enterprise value of Company B? Revenue in Year 0 59 million WACC 11% Revenue growth over the forecast 6% Steady state growth of OCF 5% period of Year 1 to Year 3 from Year 4 Cost of goods sold/Revenue 55% Tax rate 21% Selling, general and administrative 20% expenses/Revenue3. Suppose that you will use EBITDA multiple (enterprise value/EBITDA) to value Teligon IPO. You choose the following peers to determine the appropriate EBITDA multiple for Teligon. All data are for peers in millions of dollars. Total Projected Market Value Total Peers Revenue EBITDA Growth Rate of Equity Debt Creative 80.4 11.43 5.1% 46.56 67.51 High Quality 129.87 23.51 5.9% 77.91 86.69 Kwigs 108.62 18.54 9.1% 52.93 98.48 Elexig 96.20 12.73 5.95% 51.13 52.48 a. Calculate EBITDA multiple for each peer to figure out the average EBITDA multiple for peers. b. If you think that the appropriate EBITDA multiple for Teligon is the average EBITDA multiple for peers, what is the appropriate EBITDA multiple for Teligon? C. If EBITDA for Teligon was 6.87 million dollars just before IPO, the debt was 2.3 million dollars, and the number of IPO shares was 1.89 million, what should be IPO price per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts