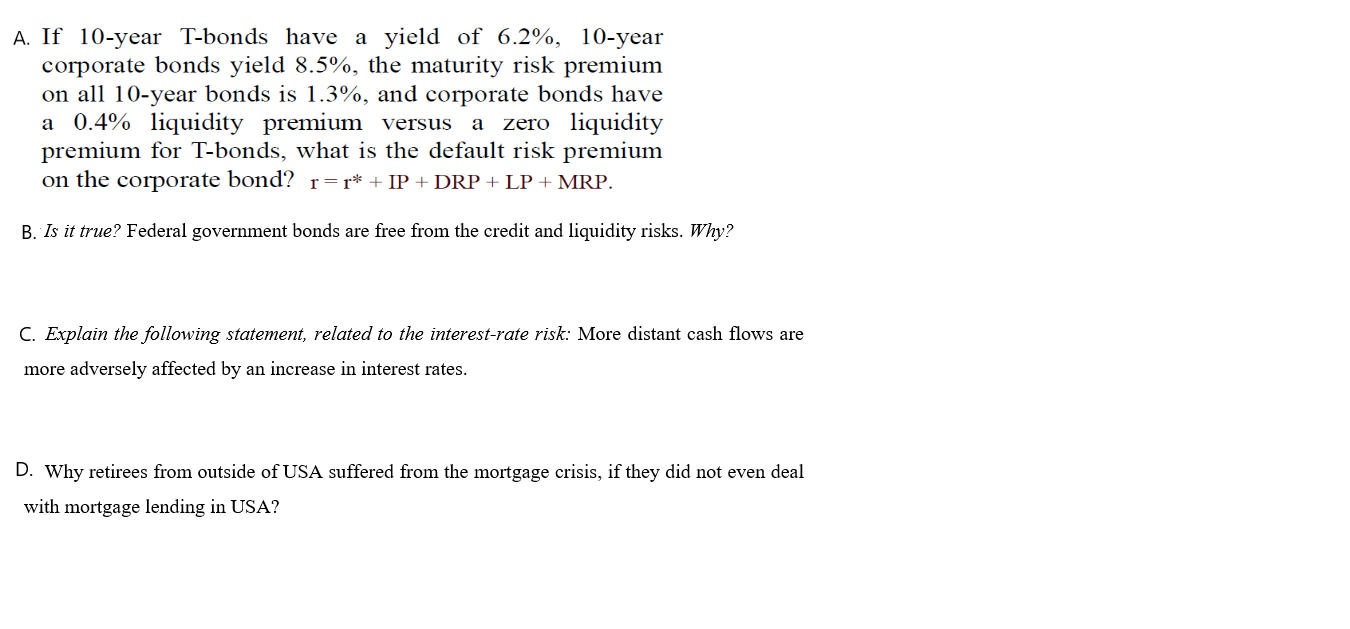

Question: A. If 10year Tbonds have a yield of 6.2%, 10year corporate bonds yield 8.5%, the maturity risk premium on all 10-year bonds is 1.3%, and

A. If 10year Tbonds have a yield of 6.2%, 10year corporate bonds yield 8.5%, the maturity risk premium on all 10-year bonds is 1.3%, and corporate bonds have a 0.4% liquidity premium versus a zero liquidity premium for Tbonds, what is the default risk premium on the corporate bond? 1- = r* + [P + BK? + LP + MRP. B_'IS it true? Federal government bonds are free from the credit and liquidity risks. Why? C. Explain the following statement. related to the interestrate risk: More distant cash ows are more adversely affected by an increase in interest rates. D. Why retirees from outside of USA suffered from the mortgage crisis, if they did not even deal with mortgage lending in USA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts