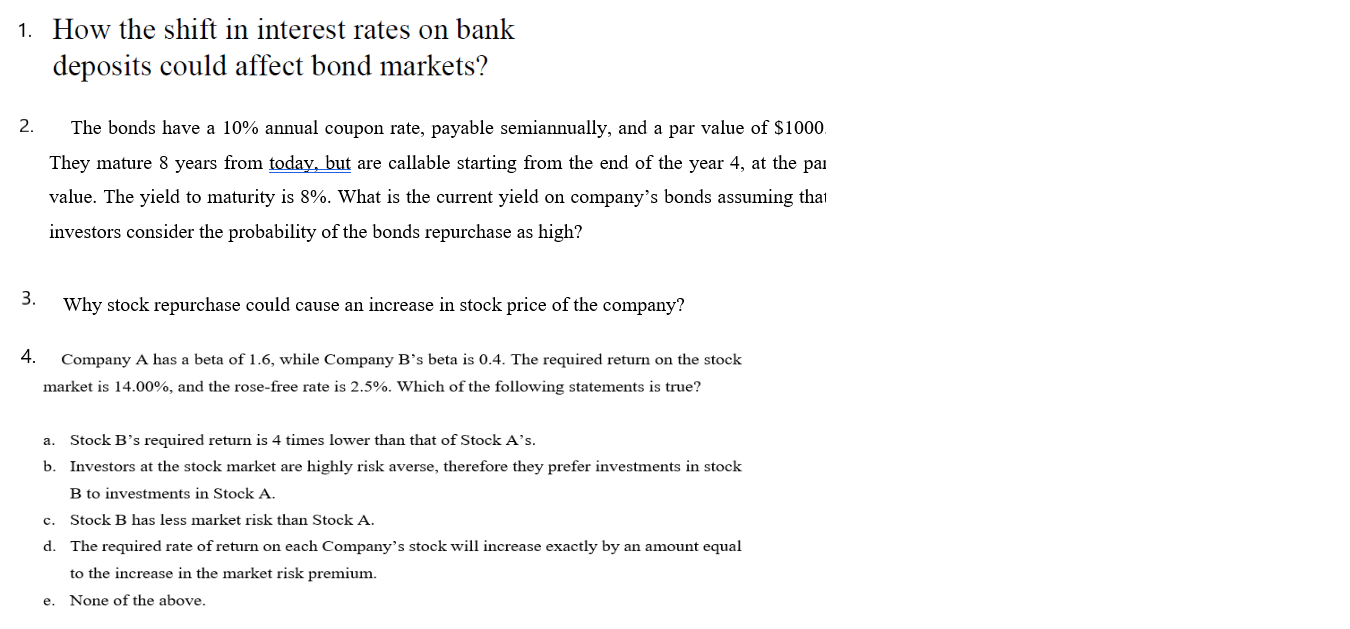

Question: 1. How the shift in interest rates on bank deposits could affect bond markets? 2. The bonds have a 10% annual coupon rate, payable semiannually,

1. How the shift in interest rates on bank deposits could affect bond markets? 2. The bonds have a 10% annual coupon rate, payable semiannually, and a par value of $1000. They mature 8 years om M are callable starting from the end of the year 4, at the pal value. The yield to maturity is 8%. What is the current yield on company's bonds assuming thal investors consider the probability of the bonds repurchase as high? 3' Why stock repurchase could cause an increase in stock price of the company? 4- Company A has a beta of 1,6, while Company B's beta is 0.4. The required return on the stock market is 14.00%, and the rose-free rate is 2.5%. Which of the following statements is true? a. Stock B's required return is 4 times lower than that of Stock A's. b. Investors at the stock market are highly risk averse, therefore they prefer investments in stock B to investments in Stock A. Stock E has less market risk than Stock A. d. The required rate ofreturn on each Company's stock will increase exactly by an amunt equal to the increase in the market risk premium. e. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts