Question: Assume the risk-free rate is rf 5% the expected total (not excess) return on the market portfolio is M 9% and the standard deviation of

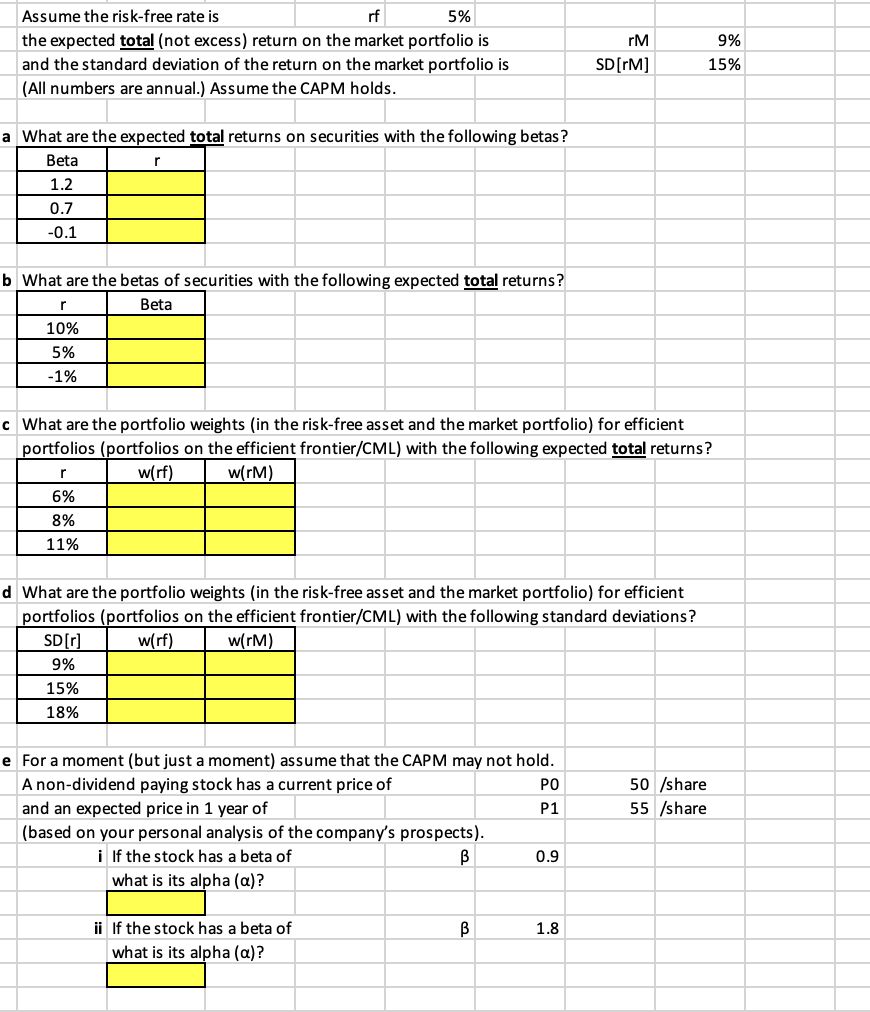

Assume the risk-free rate is rf 5% the expected total (not excess) return on the market portfolio is M 9% and the standard deviation of the return on the market portfolio is SD[rM] 15% (All numbers are annual.) Assume the CAPM holds. a What are the expected total returns on securities with the following betas? What are the portfolio weights (in the risk-free asset and the market portfolio) for efficient portfolios (portfolios on the efficient frontier/CML) with the following expected total returns? d What are the portfolio weights (in the risk-free asset and the market portfolio) for efficient portfolios (portfolios on the efficient frontier/CML) with the following standard deviations? e Fora moment (but just a moment) assume that the CAPM may not hold. A non-dividend paying stock has a current price of PO 50 /share and an expected pricein 1 year of P1 55 /share {based on your personal analysis of the company's prospects). i Ifthestock has a beta of B 0.9 what is its alpha (a)? ii Ifthestock has abeta of B 1.8 what is its alpha (a)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts