Question: The assets of a bank consist of $300 million of loans to A-rated corporations with the principals being repayable at maturity. The Probability of Default

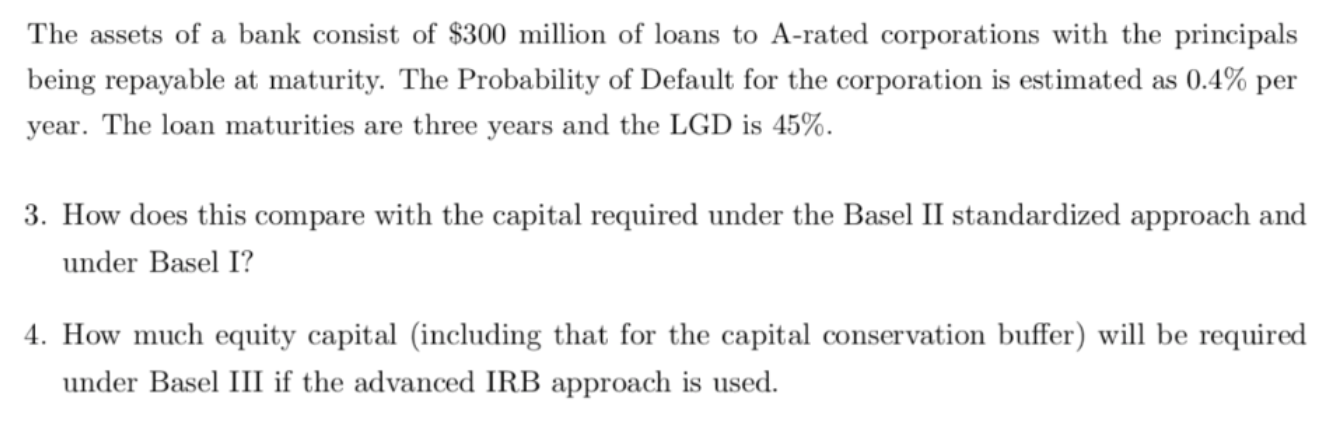

The assets of a bank consist of $300 million of loans to A-rated corporations with the principals being repayable at maturity. The Probability of Default for the corporation is estimated as 0.4% per year. The loan maturities are three years and the LGD is 45%. 3. How does this compare with the capital required under the Basel II standardized approach and under Basel I? 4. How much equity capital (including that for the capital conservation buffer) will be required under Basel III if the advanced IRB approach is used

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts