Question: c. Alex is a U.S investor. He can borrow up to $1,000,000 or the in Moroccan Dirham equivalent to USD. The spot rate of a

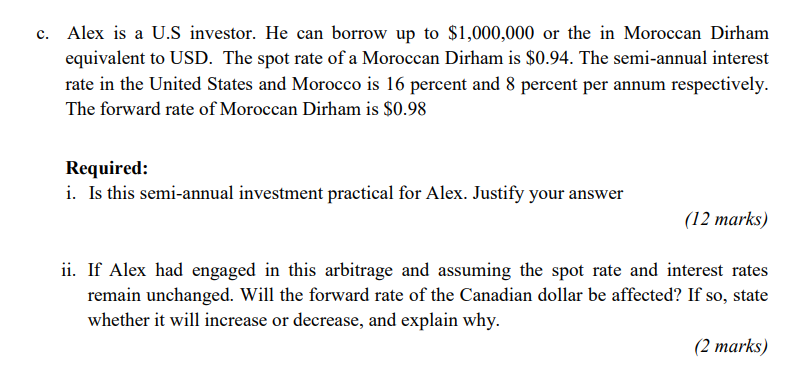

c. Alex is a U.S investor. He can borrow up to $1,000,000 or the in Moroccan Dirham equivalent to USD. The spot rate of a Moroccan Dirham is $0.94. The semi-annual interest rate in the United States and Morocco is 16 percent and 8 percent per annum respectively. The forward rate of Moroccan Dirham is $0.98 Required: i. Is this semi-annual investment practical for Alex. Justify your answer (12 marks) ii. If Alex had engaged in this arbitrage and assuming the spot rate and interest rates remain unchanged. Will the forward rate of the Canadian dollar be affected? If so, state whether it will increase or decrease, and explain why. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts