Question: Seifert Company is considering three independent projects, each reguiring $4 million in investment. The estimated internal rate of return (IRR) and cost of capital for

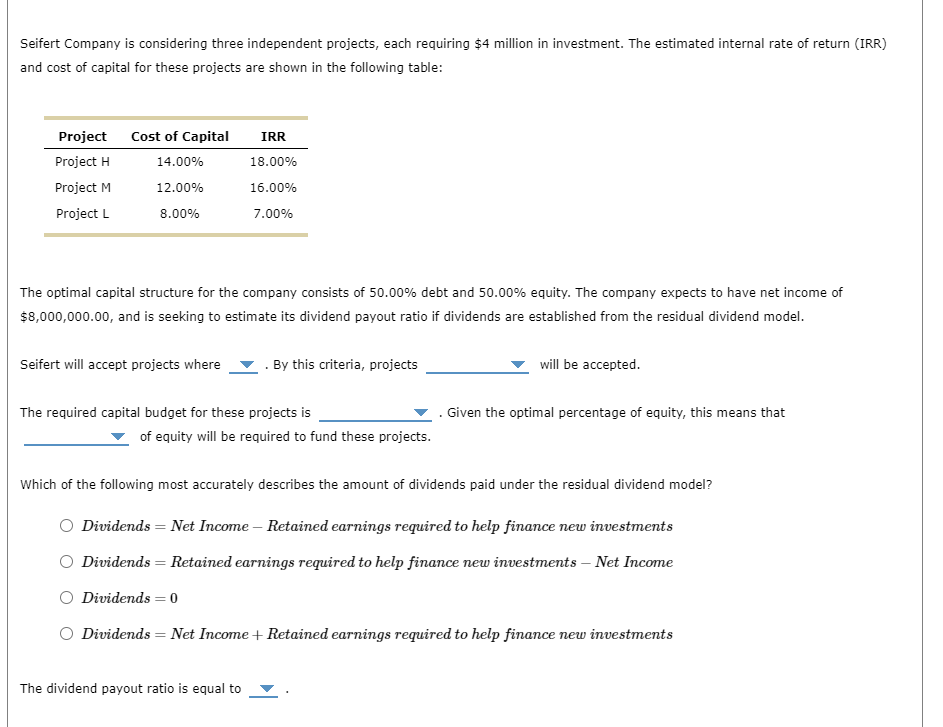

Seifert Company is considering three independent projects, each reguiring $4 million in investment. The estimated internal rate of return (IRR) and cost of capital for these projects are shown in the following table: Project Cost of Capital IRR Project H 14.00% 18.00% Project M 12.00% 16.00% Project L 8.00% 7.00% The optimal capital structurs for the company consists of 50.00% debt and 50.00% equity. The company expects to have net income of 8,000,000.00, and is s=eking to estimate its dividend payout ratio if dividends are established from the residual dividend model. Seifert will accept projects where W | By this criteria, projects w will be accepted. The required capital budget for these projects is w . Given the optimal percentage of equity, this means that w of equity will be required to fund these projects. Which of the following most accurately describes the amount of dividends paid under the residual dividend model? O Dividends = Net Income Retained earnings required to help finance new investments (O Dividends Retained earnings required to help finance new investments Net Income ) Dividends =0 O Dividends = Net Income + Retained earnings required to help finance new investments The dividend payout ratio is equal to W

Step by Step Solution

There are 3 Steps involved in it

Lets break down the given scenario step by step ensuring all questions are answered thoroughly Given Data Capital Structure 50 debt and 50 equity Net Income 8000000 Investment per Project 4000000 for ... View full answer

Get step-by-step solutions from verified subject matter experts