Question: Chrome File Edit View History Bookmarks Profiles Tab Window Help 1 4 Q 80 Sun May 12 14:46 .. . Marvel | Disney+ X N

![- Week ( X Search Results | Co x | [Solved] The](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/06/6661bc48b61ab_2246661bc4896d59.jpg)

![IPO In x | [Solved] . Er Quest x + F G](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/06/6661bc4922212_2246661bc48ee4cb.jpg)

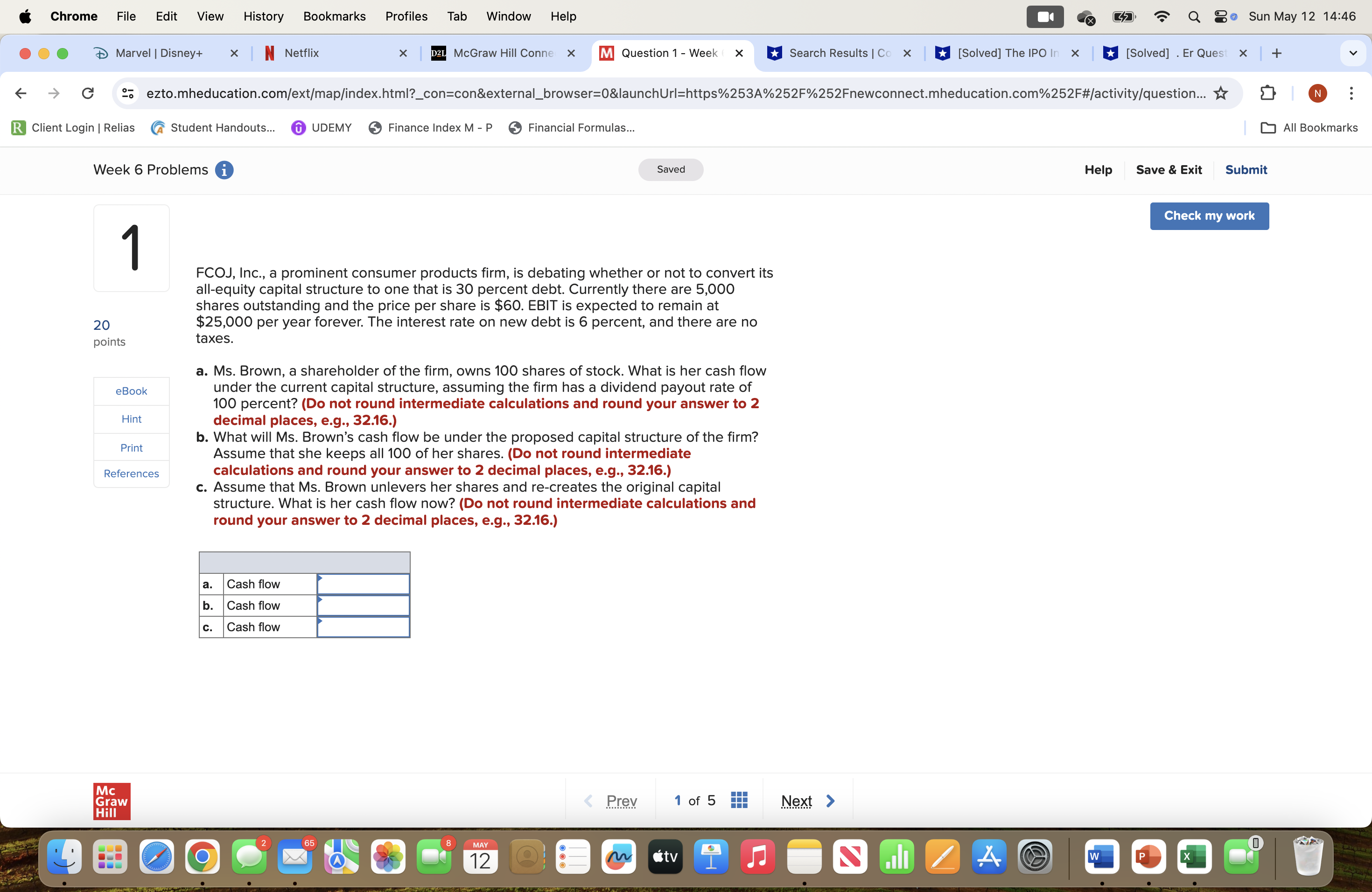

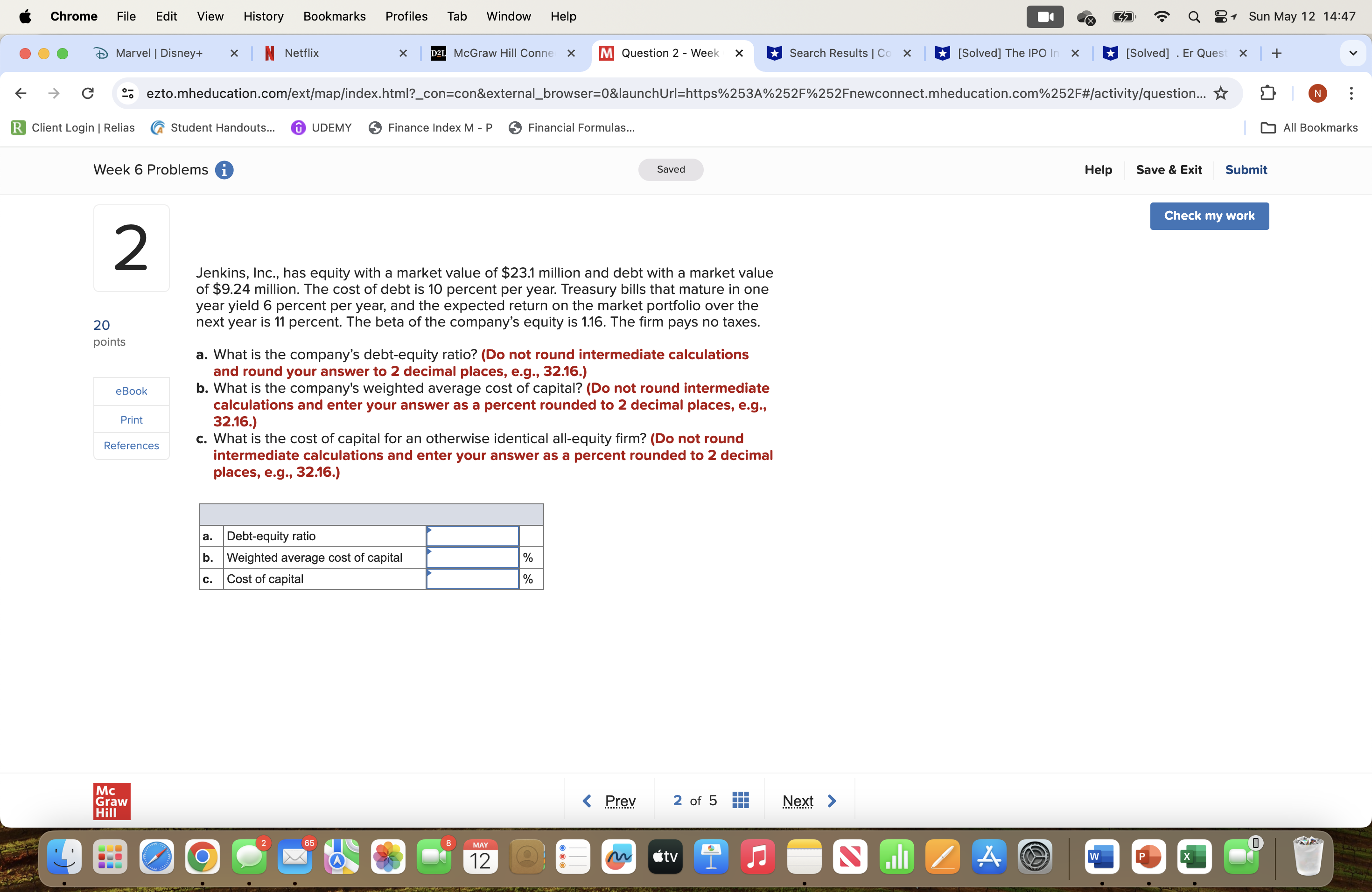

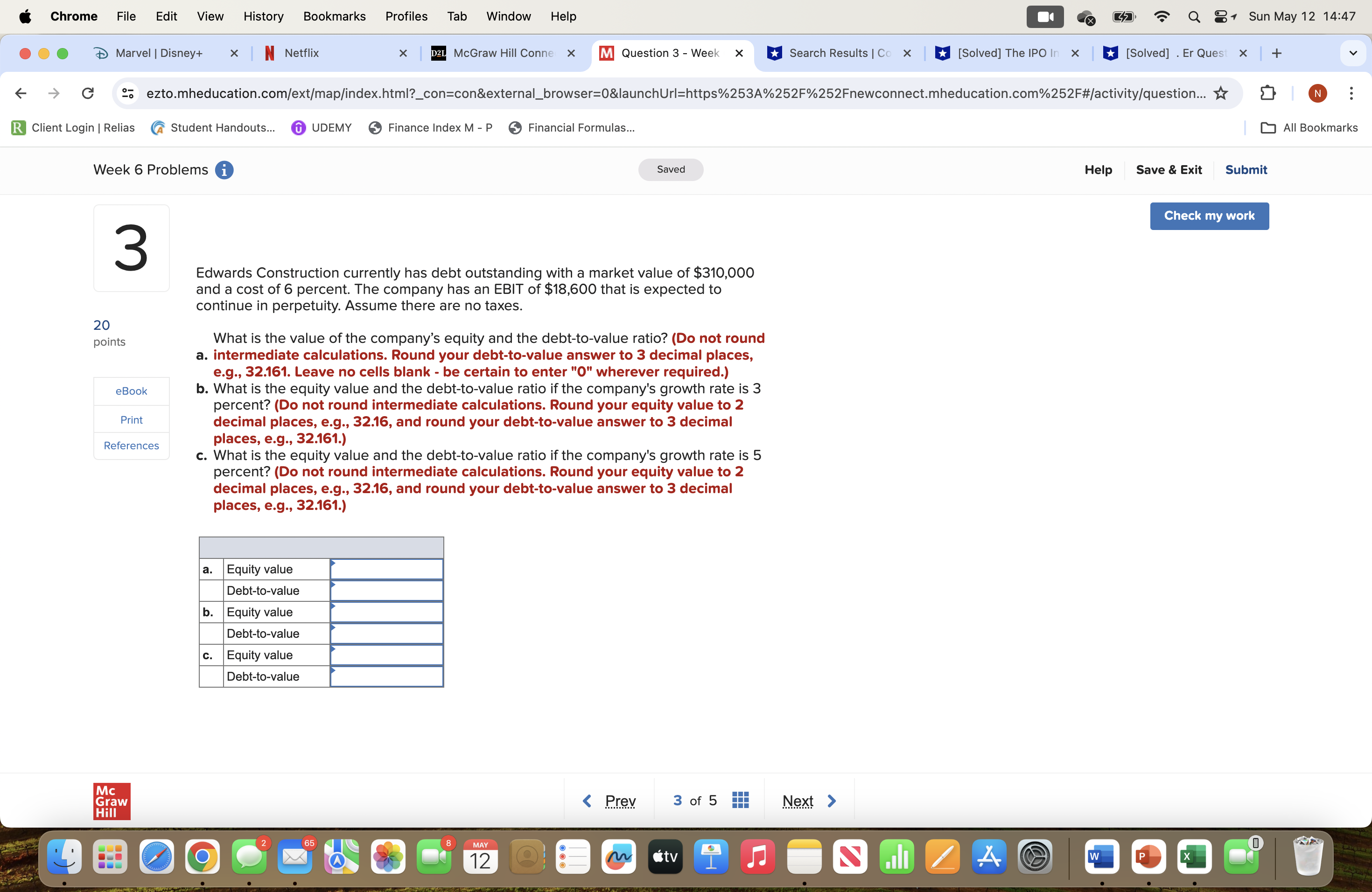

Chrome File Edit View History Bookmarks Profiles Tab Window Help 1 4 Q 80 Sun May 12 14:46 .. . Marvel | Disney+ X N Netflix x D2L McGraw Hill Conne X M Question 1 - Week ( X Search Results | Co x | [Solved] The IPO In x | [Solved] . Er Quest x + F G 9% ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/question... * R Client Login | Relias Student Handouts... @ UDEMY Finance Index M - P Financial Formulas.. All Bookmarks Week 6 Problems i Saved Help Save & Exit Submit Check my work FCOJ, Inc., a prominent consumer products firm, is debating whether or not to convert its all-equity capital structure to one that is 30 percent debt. Currently there are 5,000 shares outstanding and the price per share is $60. EBIT is expected to remain at 20 $25,000 per year forever. The interest rate on new debt is 6 percent, and there are no points taxes. a. Ms. Brown, a shareholder of the firm, owns 100 shares of stock. What is her cash flow eBook under the current capital structure, assuming the firm has a dividend payout rate of 00 percent? (Do not round intermediate calculations and round your answer to 2 Hint decimal places, e.g., 32.16.) b. What will Ms. Brown's cash flow be under the proposed capital structure of the firm? Print Assume that she keeps all 100 of her shares. (Do not round intermediate References calculations and round your answer to 2 decimal places, e.g., 32.16.) c. Assume that Ms. Brown unlevers her shares and re-creates the original capital structure. What is her cash flow now? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a. Cash flow b. Cash flow C. Cash flow Mc Graw Hill 65 MAY 12Chrome File Edit View History Bookmarks Profiles Tab Window Help 1 4 Q 1 Sun May 12 14:47 .. . Marvel | Disney+ X N Netflix x D2L McGraw Hill Conne X M Question 2 - Week X Search Results | Co x | [Solved] The IPO In x | [Solved] . Er Quest x + G 9% ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/question... * R Client Login | Relias Student Handouts... @ UDEMY Finance Index M - P Financial Formulas.. All Bookmarks Week 6 Problems i Saved Help Save & Exit Submit Check my work 2 Jenkins, Inc., has equity with a market value of $23.1 million and debt with a market value of $9.24 million. The cost of debt is 10 percent per year. Treasury bills that mature in one year yield 6 percent per year, and the expected return on the market portfolio over the 20 next year is 11 percent. The beta of the company's equity is 1.16. The firm pays no taxes. points a. What is the company's debt-equity ratio? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) eBook b. What is the company's weighted average cost of capital? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., Print 32.16.) References c. What is the cost of capital for an otherwise identical all-equity firm? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) a. Debt-equity ratio b. Weighted average cost of capital % C. Cost of capital 1% Mc Graw Hill 65 MAY 12 M tvChrome File Edit View History Bookmarks Profiles Tab Window Help 1 4 Q 1 Sun May 12 14:47 .. . Marvel | Disney+ X N Netflix x D2L McGraw Hill Conne X M Question 3 - Week X Search Results | Co x | [Solved] The IPO In x | [Solved] . Er Quest x + F G 9% ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/question... * R Client Login | Relias Student Handouts... @ UDEMY Finance Index M - P Financial Formulas... All Bookmarks Week 6 Problems i Saved Help Save & Exit Submit Check my work 3 Edwards Construction currently has debt outstanding with a market value of $310,000 and a cost of 6 percent. The company has an EBIT of $18,600 that is expected to continue in perpetuity. Assume there are no taxes. 20 points What is the value of the company's equity and the debt-to-value ratio? (Do not round a. intermediate calculations. Round your debt-to-value answer to 3 decimal places, e.g., 32.161. Leave no cells blank - be certain to enter "O" wherever required.) eBook b. What is the equity value and the debt-to-value ratio if the company's growth rate is 3 percent? (Do not round intermediate calculations. Round your equity value to 2 Print decimal places, e.g., 32.16, and round your debt-to-value answer to 3 decimal References places, e.g., 32.161.) c. What is the equity value and the debt-to-value ratio if the company's growth rate is 5 percent? (Do not round intermediate calculations. Round your equity value to 2 decimal places, e.g., 32.16, and round your debt-to-value answer to 3 decimal places, e.g., 32.161.) a. Equity value Debt-to-value b. Equity value Debt-to-value C. Equity value Debt-to-value Mc Graw Hill MAY 12 M tvChrome File Edit View History Bookmarks Profiles Tab Window Help 1 4 Q 1 Sun May 12 14:47 .. . Marvel | Disney+ X N Netflix x D2L McGraw Hill Conne X M Question 4 - Week X Search Results | Co x | [Solved] The IPO In x | [Solved] . Er Quest x + F G 9% ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/question... * R Client Login | Relias Student Handouts... @ UDEMY Finance Index M - P Financial Formulas.. All Bookmarks Week 6 Problems i Saved Help Save & Exit Submit Check my work 4 Connor Corp. has an EBIT of $1,030,000 per year that is expected to continue in perpetuity. The unlevered cost of equity for the company is 14 percent, and the corporate tax rate is 23 percent. The company also has a perpetual bond issue 20 outstanding with a market value of $2.03 million. What is the value of the company? (Do points not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to the nearest whole dollar, e.g., 1,234,567.) eBook Value of the company Print References Mc Graw Hill 65 MAY 12 M tvChrome File Edit View History Bookmarks Profiles Tab Window Help 1 4 Q 1 Sun May 12 14:47 .. . Marvel | Disney+ X N Netflix x D2L McGraw Hill Conne X M Question 5 - Week X Search Results | Co x | [Solved] The IPO In x | [Solved] . Er Quest x |+ G 9% ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/question... * R Client Login | Relias Student Handouts... UDEMY Finance Index M - P Financial Formulas.. All Bookmarks Week 6 Problems i Saved Help Save & Exit Submit Check my work 5 The balance sheet for Kare Corp. is shown here in market value terms. There are 8,000 shares of stock outstanding. 20 Market Value Balance Sheet points Cash $ 45,600 Equity $545,600 Fixed 500,000 eBook assets Hint Total 545,600 Total $545,600 Print References The company has declared a dividend of $1.90 per share. The stock goes ex dividend tomorrow . a. Ignoring any tax effects, what is the stock selling for today? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. Ignoring any tax effects, what will the stock sell for tomorrow? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) . Stock price b. Stock price Mc Graw Hill MAY 12 tv

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts