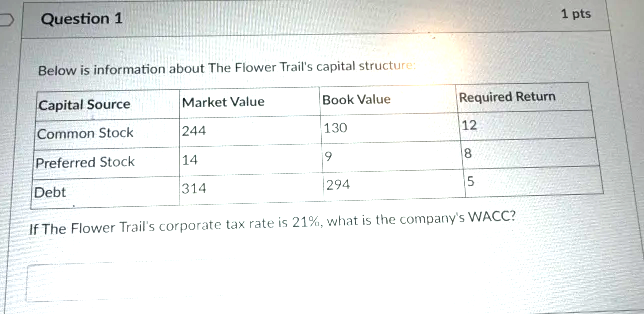

Question: Question 1 1 pts Below is information about The Flower Trail's capital structure: Capital Source Market Value Book Value Required Return Common Stock 244 130

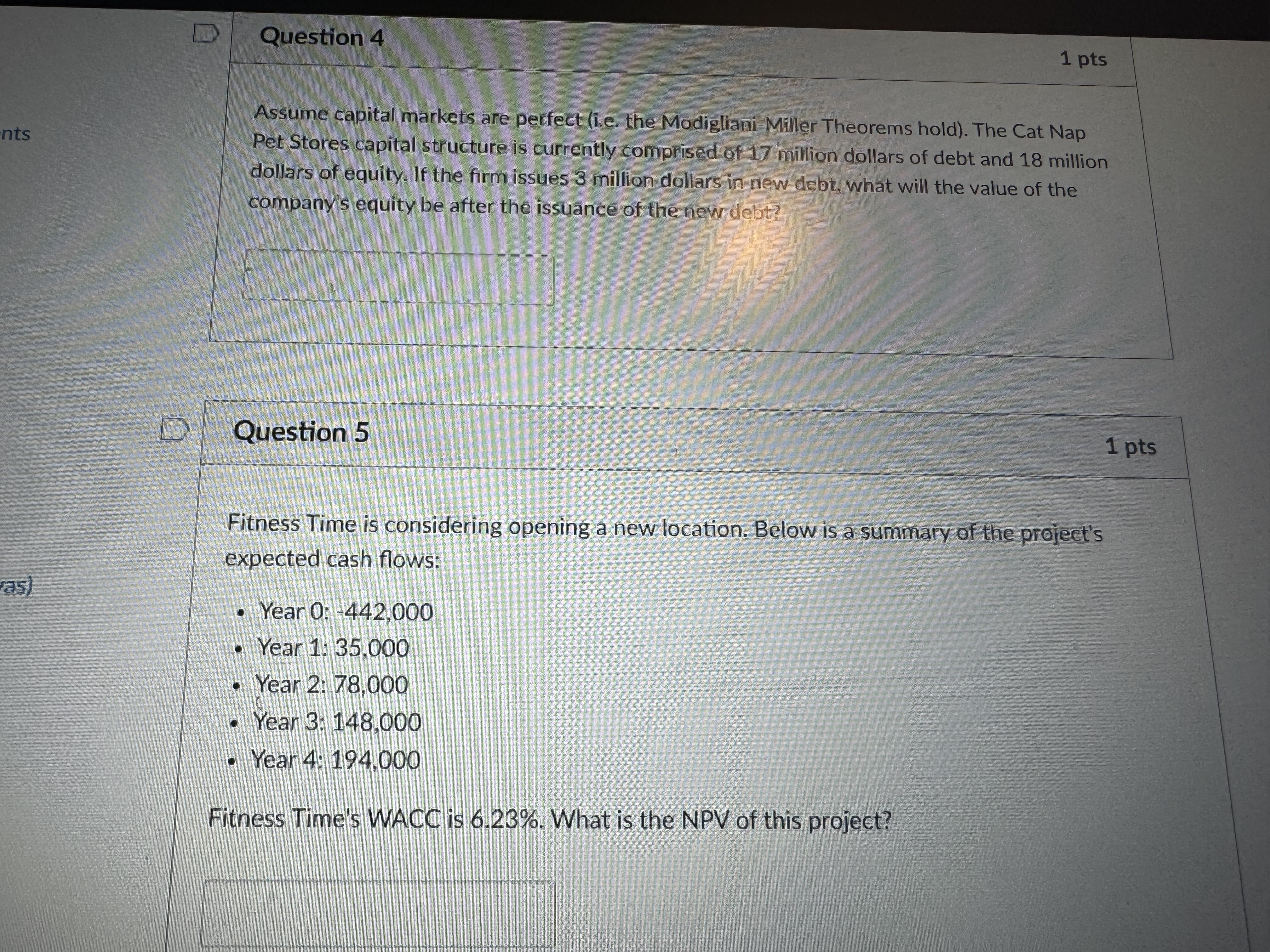

Question 1 1 pts Below is information about The Flower Trail's capital structure: Capital Source Market Value Book Value Required Return Common Stock 244 130 12 Preferred Stock 14 9 8 Debt 314 294 5 If The Flower Trail's corporate tax rate is 21%, what is the company's WACC?D Question 4 1 pts Assume capital markets are perfect (i.e. the Modigliani-Miller Theorems hold). The Cat Nap nts Pet Stores capital structure is currently comprised of 17 million dollars of debt and 18 million dollars of equity. If the firm issues 3 million dollars in new debt, what will the value of the company's equity be after the issuance of the new debt? Question 5 1 pts Fitness Time is considering opening a new location. Below is a summary of the project's expected cash flows: as) . Year 0: -442,000 . Year 1: 35,000 . Year 2: 78,000 . Year 3: 148,000 . Year 4: 194,000 Fitness Time's WACC is 6.23%. What is the NPV of this project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts