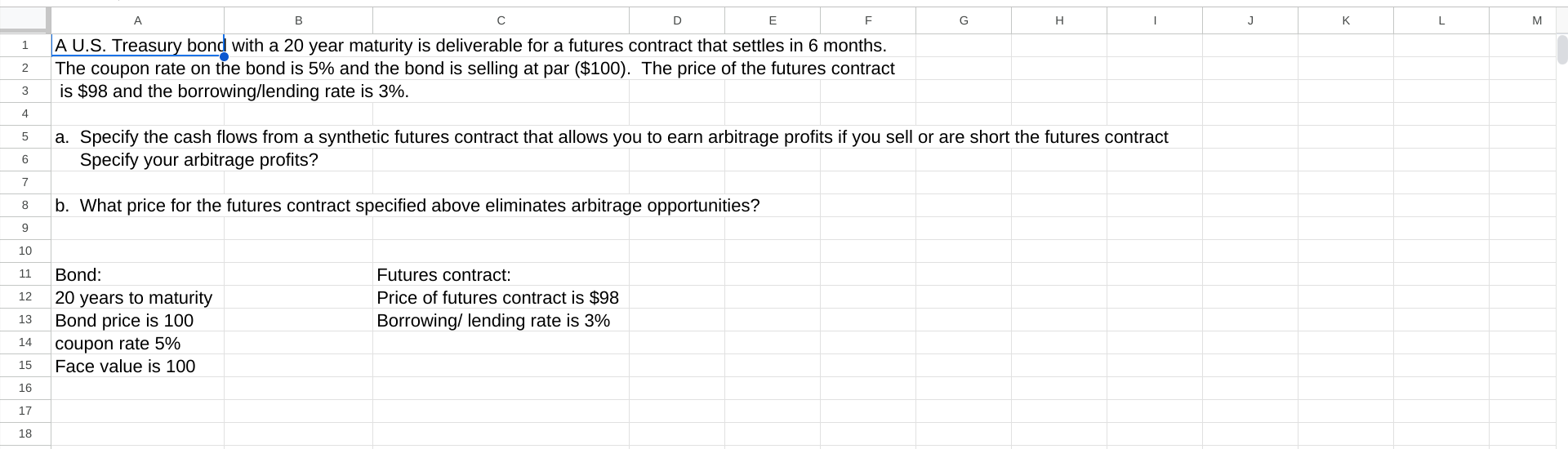

Question: A B C D E F G H A U.S. Treasury bomiwith a 20 year maturity is deliverable for a futures contract that settles in

A B C D E F G H A U.S. Treasury bomiwith a 20 year maturity is deliverable for a futures contract that settles in 6 months. The coupon rate on the bond is 5% and the bond is selling at par ($100). The price of the futures contract is $98 and the borrowing/lending rate is 3%. a. Specify the cash flows from a synthetic futures contract that allows you to earn arbitrage profits if you sell or are short the futures contract Specify your arbitrage profits? b. What price for the futures contract specified above eliminates arbitrage opportunities? o N o e s W N e 10 1 12 13 14 15 16 17 18 Bond: 20 years to maturity Bond price is 100 coupon rate 5% Face value is 100 Futures contract: Price of futures contract is $98 Borrowing/ lending rate is 3%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts