Question: Your company has been doing well, reaching $1.13 million in earnings, and is considering launching a new product. Designing the new product has already cost

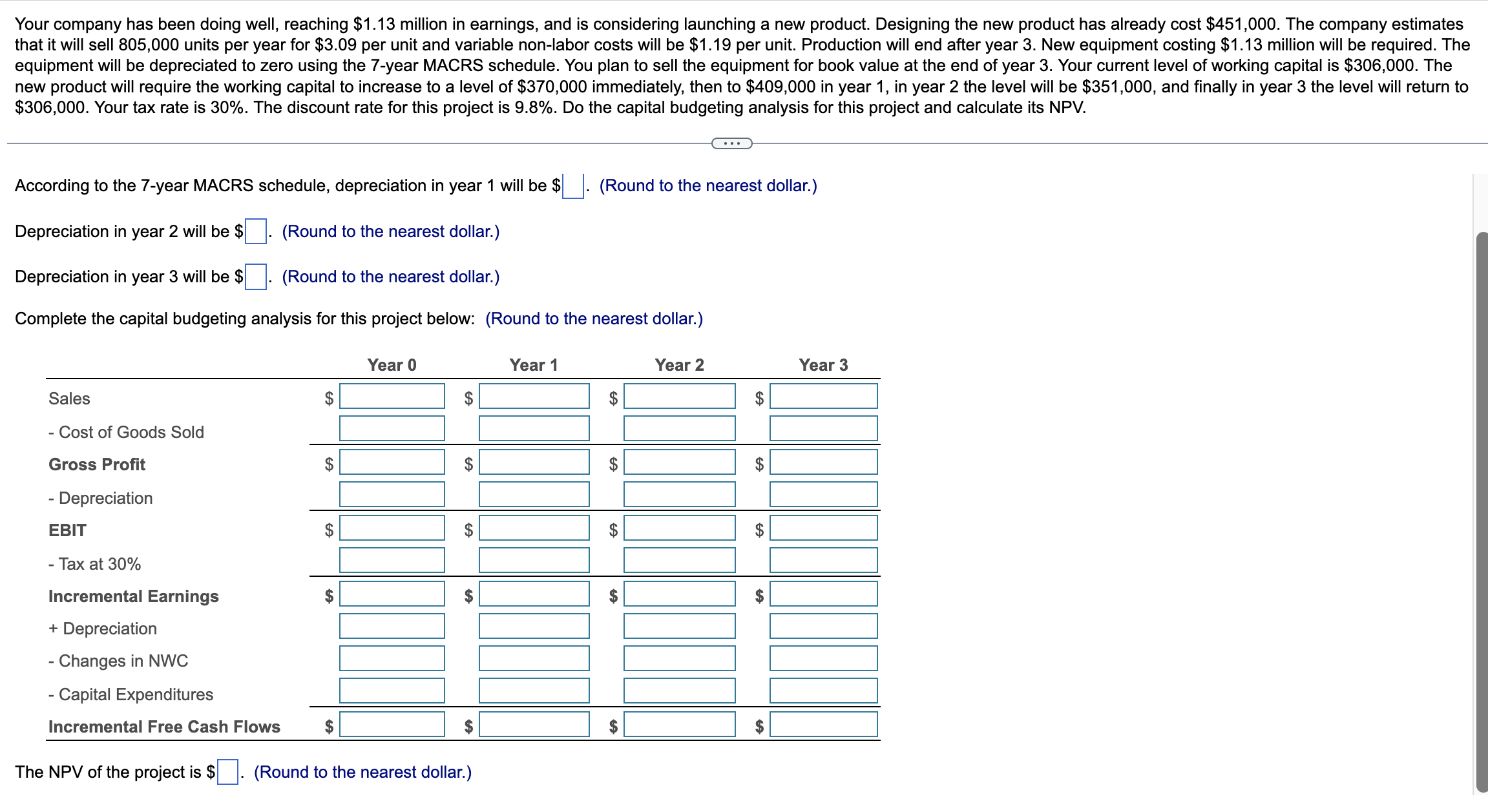

Your company has been doing well, reaching $1.13 million in earnings, and is considering launching a new product. Designing the new product has already cost $451,000. The company estimates that it will sell 805,000 units per year for $3.09 per unit and variable non-labor costs will be $1.19 per unit. Production will end after year 3. New equipment costing $1.13 million will be required. The equipment will be depreciated to zero using the 7-year MACRS schedule. You plan to sell the equipment for book value at the end of year 3. Your current level of working capital is $306,000. The new product will require the working capital to increase to a level of $370,000 immediately, then to $409,000 in year 1, in year 2 the level will be $351,000, and finally in year 3 the level will return to $306,000. Your tax rate is 30%. The discount rate for this project is 9.8%. Do the capital budgeting analysis for this project and calculate its NPV. According to the 7-year MACRS schedule, depreciation in year 1 will be $|_|. (Round to the nearest dollar.) Depreciation in year 2 willbe $| |. (Round to the nearest dollar.) Depreciation in year 3 willbe $| |. (Round to the nearest dollar.) Complete the capital budgeting analysis for this project below: (Round to the nearest dollar.) Year 0 Year 1 Year 2 Year 3 Sales $ $ $ $ - Cost of Goods Sold Gross Profit $ $ $ $ - Depreciation EBIT $ $ $ $ - Tax at 30% Incremental Earnings $ $ $ $ + Depreciation - Changes in NWC - Capital Expenditures Incremental Free Cash Flows $ $ $ $ The NPV of the projectis $| |. (Round to the nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts