Question: Chrome File Edit View History Bookmarks Profiles Tab Window Help Q 1 Sat May 11 18:22 N Blood of Zeus - Netflix X D2L McGraw

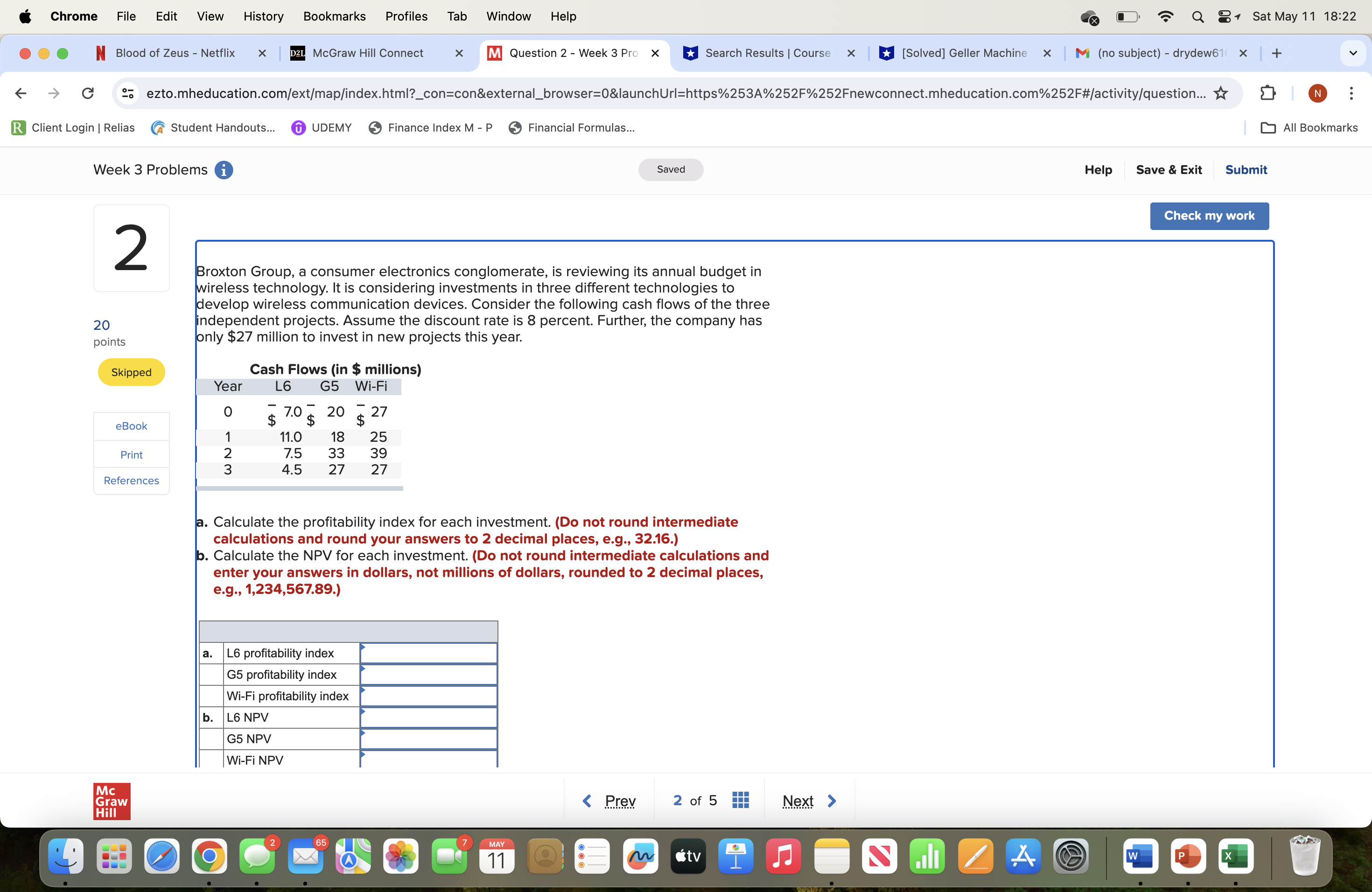

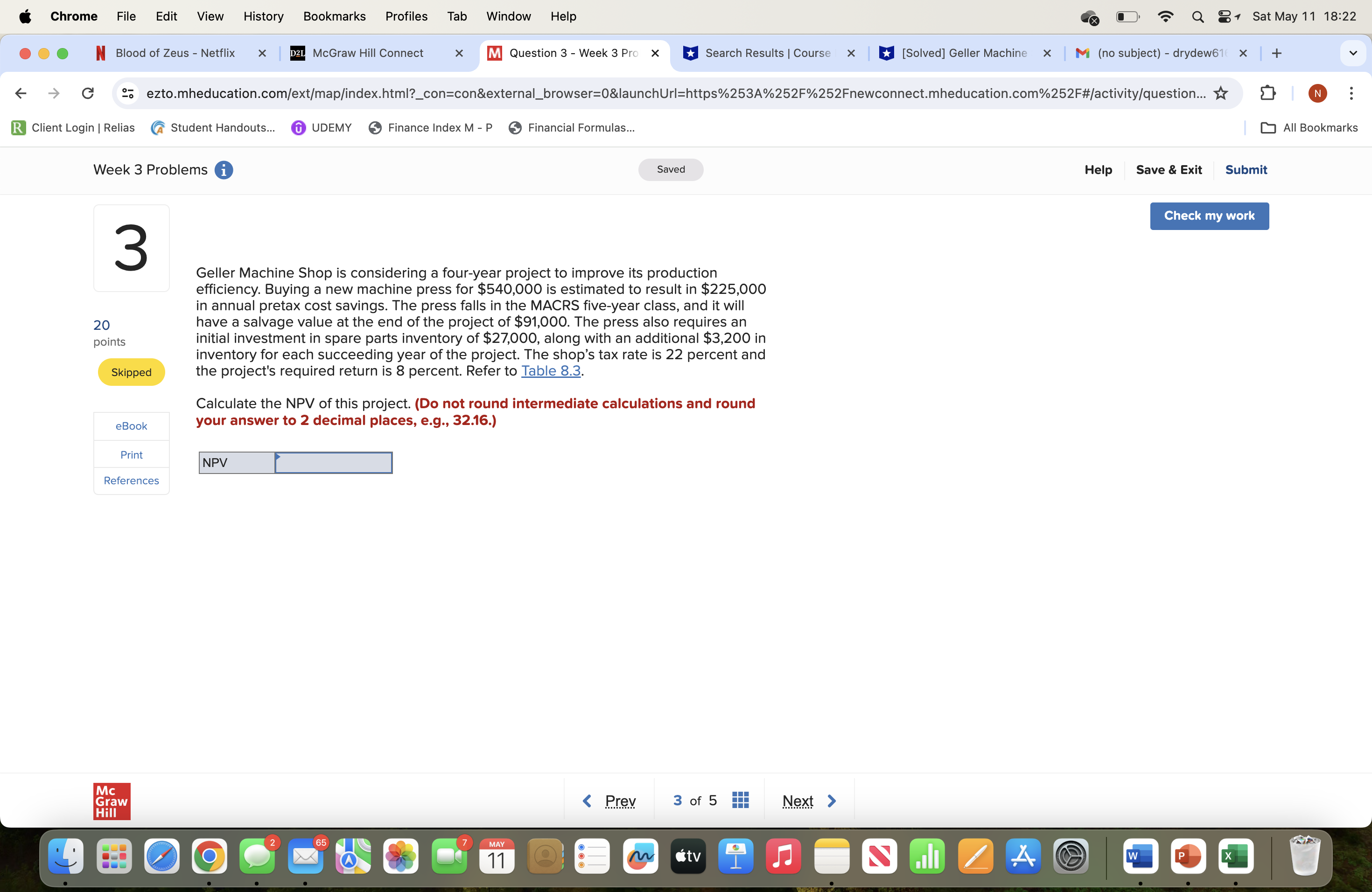

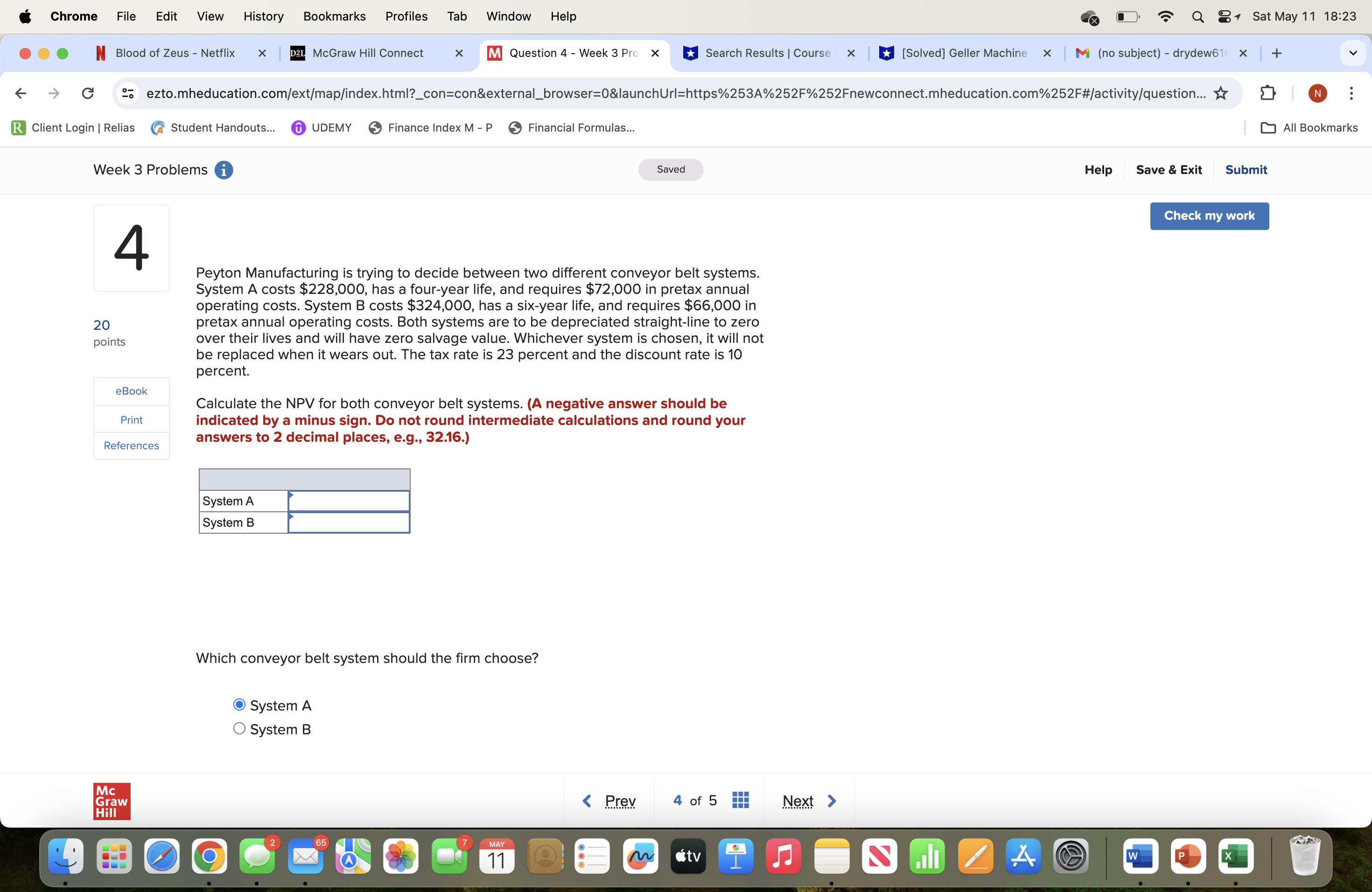

Chrome File Edit View History Bookmarks Profiles Tab Window Help Q 1 Sat May 11 18:22 N Blood of Zeus - Netflix X D2L McGraw Hill Connect x M Question 2 - Week 3 Pro X Search Results | Course X [Solved] Geller Machine x M (no subject) - drydew61( x G 2 ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/question... * R Client Login | Relias Student Handouts... UDEMY Finance Index M - P Financial Formulas.. All Bookmarks Week 3 Problems i Saved Help Save & Exit Submit Check my work 2 Broxton Group, a consumer electronics conglomerate, is reviewing its annual budget in wireless technology. It is considering investments in three different technologies to develop wireless communication devices. Consider the following cash flows of the three 20 independent projects. Assume the discount rate is 8 percent. Further, the company has points only $27 million to invest in new projects this year. Skipped Cash Flows (in $ millions) Year L6 G5 Wi-Fi 0 $ 7.0 20 - 27 eBook 11.0 18 25 Print WN- 7.5 33 39 4.5 27 27 References a. Calculate the profitability index for each investment. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) b. Calculate the NPV for each investment. (Do not round intermediate calculations and enter your answers in dollars, not millions of dollars, rounded to 2 decimal places, e.g., 1,234,567.89.) a. L6 profitability index G5 profitability index Wi-Fi profitability index b. L6 NPV G5 NPV Wi-Fi NPV Mc Graw Hill 7 MAY 11 stvChrome File Edit View History Bookmarks Profiles Tab Window Help Q 1 Sat May 11 18:22 N Blood of Zeus - Netflix X D2L McGraw Hill Connect x M Question 3 - Week 3 Pro X Search Results | Course x [Solved] Geller Machine x M (no subject) - drydew61( x G 2 ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/question... * R Client Login | Relias Student Handouts... @ UDEMY Finance Index M - P Financial Formulas... All Bookmarks Week 3 Problems i Saved Help Save & Exit Submit Check my work 3 Geller Machine Shop is considering a four-year project to improve its production efficiency. Buying a new machine press for $540,000 is estimated to result in $225,000 in annual pretax cost savings. The press falls in the MACRS five-year class, and it will 20 have a salvage value at the end of the project of $91,000. The press also requires an points initial investment in spare parts inventory of $27,000, along with an additional $3,200 in inventory for each succeeding year of the project. The shop's tax rate is 22 percent and Skipped the project's required return is 8 percent. Refer to Table 8.3. Calculate the NPV of this project. (Do not round intermediate calculations and round eBook your answer to 2 decimal places, e.g., 32.16.) Print NPV References Mc Graw Hill 7 MAY 11 stvChrome File Edit View History Bookmarks Profiles Tab Window Help Q 91 Sat May 11 18:23 N Blood of Zeus - Netflix X D2L McGraw Hill Connect x M Question 4 - Week 3 Pro X Search Results | Course X [Solved] Geller Machine x M (no subject) - drydew61( x G 2 ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/question... * R Client Login | Relias Student Handouts... @ UDEMY Finance Index M - P Financial Formulas... All Bookmarks Week 3 Problems i Saved Help Save & Exit Submit Check my work 4 Peyton Manufacturing is trying to decide between two different conveyor belt systems. System A costs $228,000, has a four-year life, and requires $72,000 in pretax annual operating costs. System B costs $324,000, has a six-year life, and requires $66,000 in 20 pretax annual operating costs. Both systems are to be depreciated straight-line to zero points over their lives and will have zero salvage value. Whichever system is chosen, it will not be replaced when it wears out. The tax rate is 23 percent and the discount rate is 10 percent. eBook Calculate the NPV for both conveyor belt systems. (A negative answer should be Print indicated by a minus sign. Do not round intermediate calculations and round your References answers to 2 decimal places, e.g., 32.16.) System A System B Which conveyor belt system should the firm choose? O System A O System B Mc Graw Hill 7 MAY 11 stv

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts