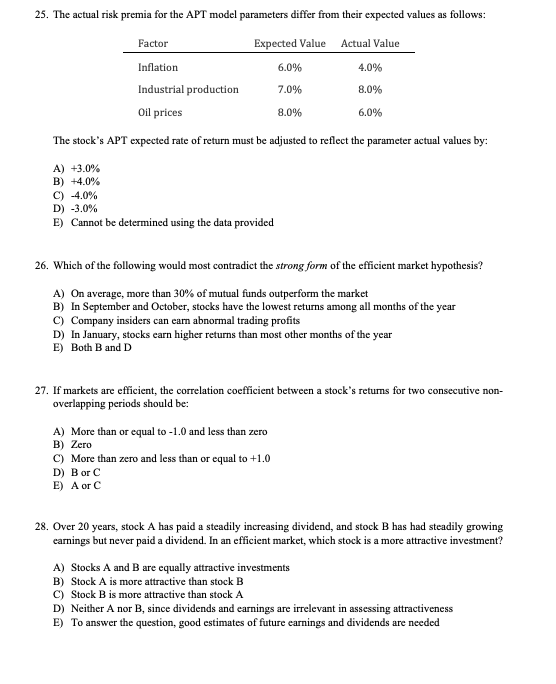

Question: 25. The actual risk premia for the APT model parameters differ from their expected values as follows: Factor Expected Value Actual Value Inflation 6.0% 4.0%

25. The actual risk premia for the APT model parameters differ from their expected values as follows: Factor Expected Value Actual Value Inflation 6.0% 4.0% Industrial production 7.0% 8.0% Oil prices 8.0% 6.0% The stock's APT expected rate of return must be adjusted to reflect the parameter actual values by: A) +3.0% B) +4.0% C) -4.0% D) -3.0% E) Cannot be determined using the data provided 26. Which of the following would most contradict the strong form of the efficient market hypothesis? A) On average, more than 30% of mutual funds outperform the market B) In September and October, stocks have the lowest returns among all months of the year C) Company insiders can earn abnormal trading profits D) In January, stocks earn higher returns than most other months of the year E) Both B and D 27. If markets are efficient, the correlation coefficient between a stock's returns for two consecutive non- overlapping periods should be: A) More than or equal to -1.0 and less than zero B) Zero C) More than zero and less than or equal to +1.0 D) B or C E) A or C 28. Over 20 years, stock A has paid a steadily increasing dividend, and stock B has had steadily growing earnings but never paid a dividend. In an efficient market, which stock is a more attractive investment? A) Stocks A and B are equally attractive investments B) Stock A is more attractive than stock B C) Stock B is more attractive than stock A D) Neither A nor B, since dividends and earnings are irrelevant in assessing attractiveness E) To answer the question, good estimates of future earnings and dividends are needed

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts