Question: Two depository institutions have composite CAMELS ratings of 1 or 2 and are well capitalized. Thus, each institution falls into the FDIC Risk Category I

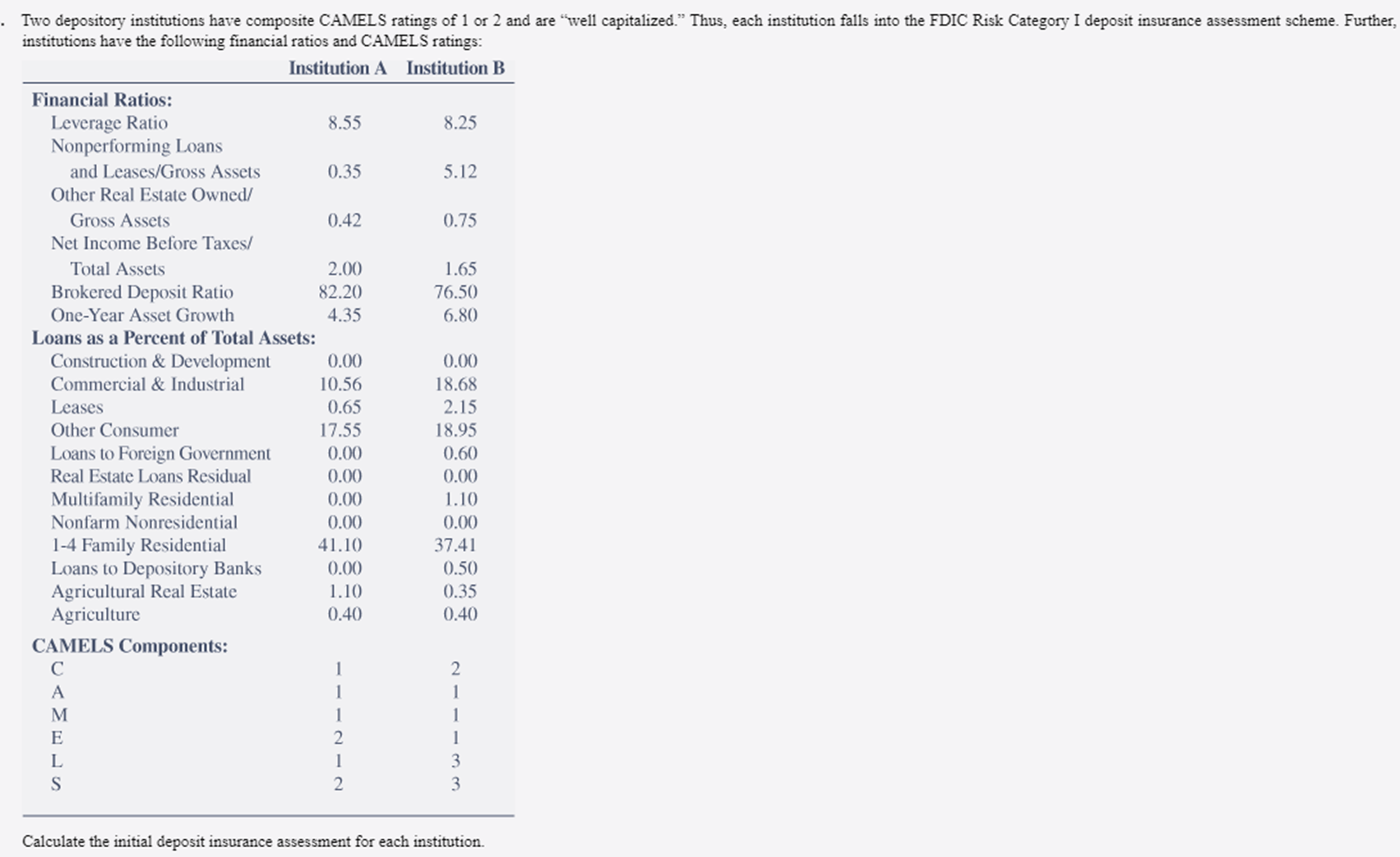

Two depository institutions have composite CAMELS ratings of 1 or 2 and are "well capitalized." Thus, each institution falls into the FDIC Risk Category I deposit insurance assessment scheme. Further, institutions have the following financial ratios and CAMELS ratings: Institution A Institution B Financial Ratios: Leverage Ratio 8.55 8.25 Nonperforming Loans and Leases/Gross Assets 0.35 5.12 Other Real Estate Owned/ Gross Assets 0.42 0.75 Net Income Before Taxes/ Total Assets 2.00 1.65 Brokered Deposit Ratio 82.20 76.50 One-Year Asset Growth 4.35 6.80 Loans as a Percent of Total Assets: Construction & Development 0.00 0.00 Commercial & Industrial 10.56 18.68 Leases 0.65 2.15 Other Consumer 17.55 18.95 Loans to Foreign Government 0.00 0.60 Real Estate Loans Residual 0.00 0.00 Multifamily Residential 0.00 1.10 Nonfarm Nonresidential 0.00 0.00 1-4 Family Residential 41.10 37.41 Loans to Depository Banks 0.00 0.50 Agricultural Real Estate 1.10 0.35 Agriculture 0.40 0.40 CAMELS Components: C - N M E N - N - W w - Calculate the initial deposit insurance assessment for each institution

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts