Question: Simplicity Investors, Inc. i1s a Wellington-based consulting company. The company is currently considering the purchase of a $385.000 automating machine with an economic life of

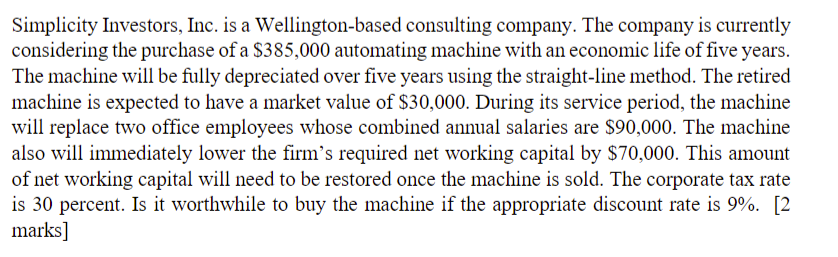

Simplicity Investors, Inc. i1s a Wellington-based consulting company. The company is currently considering the purchase of a $385.000 automating machine with an economic life of five years. The machine will be fully depreciated over five years using the straight-line method. The retired machine is expected to have a market value of $30,000. During its service period. the machine will replace two office employees whose combined annual salaries are $90.000. The machine also will immediately lower the firm's required net working capital by $70.000. This amount of net working capital will need to be restored once the machine is sold. The corporate tax rate is 30 percent. Is it worthwhile to buy the machine if the appropriate discount rate is 9%. [2 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts