Question: Denon is planning to introduce a new DVD player. It seeks your advice on whether this project should be taken up. . The initial investment

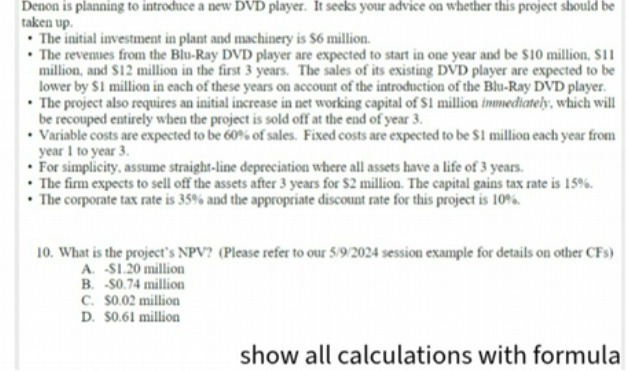

Denon is planning to introduce a new DVD player. It seeks your advice on whether this project should be taken up. . The initial investment in plant and machinery is $6 million. . The revenues from the Blu-Ray DVD player are expected to start in one year and be $10 million, SII million, and $12 million in the first 3 years. The sales of its existing DVD player are expected to be lower by $1 million in each of these years on account of the introduction of the Blu-Ray DVD player. . The project also requires an initial increase in net working capital of $1 million immediately, which will be recouped entirely when the project is sold off at the end of year 3. . Variable costs are expected to be 60% of sales. Fixed costs are expected to be $1 million each year from year I to year 3. . For simplicity, assume straight-line depreciation where all assets have a life of 3 years. . The firm expects to sell off the assets after 3 years for $2 million. The capital gains tax rate is 15%. . The corporate tax rate is 35% and the appropriate discount rate for this project is 10%. 10. What is the project's NPV? (Please refer to our 5/9/2024 session example for details on other CFs) A. -$1.20 million B. -50.74 million C. $0.02 million D. 50.61 million show all calculations with formula

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts