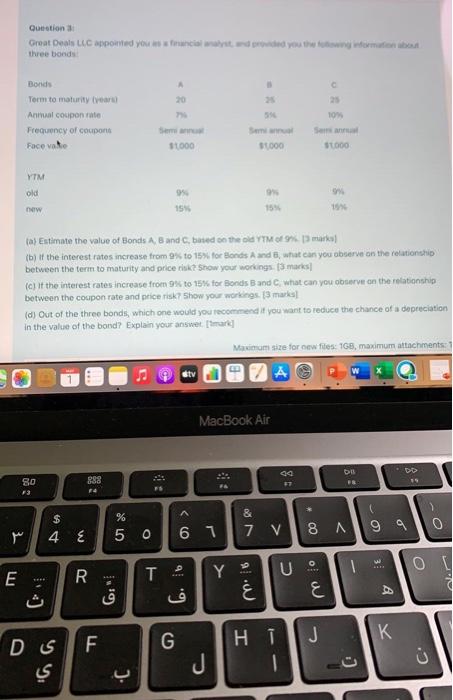

Question: LU 3 E Question 3 Great Deals LLC appointed you as a financial analyst, and provided you the following information about three bonds Bonds

LU 3 E Question 3 Great Deals LLC appointed you as a financial analyst, and provided you the following information about three bonds Bonds Term to maturity (years) Annual coupon rate i Frequency of coupons Face vate YTM old new 80 F3 54 $ (a) Estimate the value of Bonds A, B and C, based on the old YTM of 9% [3 marks) (b) If the interest rates increase from 9% to 15% for Bonds A and B, what can you observe on the relationship between the term to maturity and price risk? Show your workings. [3 marks] D (c) If the interest rates increase from 9% to 15% for Bonds B and C, what can you observe on the relationship between the coupon rate and price risk? Show your workings. [3 marks] (d) Out of the three bonds, which one would you recommend if you want to reduce the chance of a depreciation in the value of the bond? Explain your answer. [tmark] LS 888 F4 R F 20 7% Semiannua $1,000 % 50 **** 19 J. 9% 15% 24 FS T stv ^ B 25 5% Semiannual $1,000 61 9 9 G J 9% 15% MacBook Air Y Maximum size for new files: 1GB, maximum attachments: 1 A 9. W & 7 V 10% Semiannual $1,000 84 HT U 1 9% 19% O of w 8 A 9 9 J bil FR 1 17 W A DD K O C' 0 27

Step by Step Solution

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts