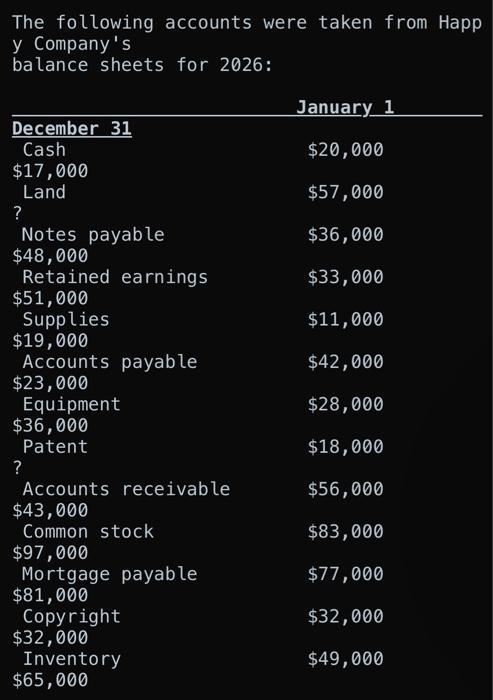

Question: The following accounts were taken from Happ y Company's balance sheets for 2026: December 31 Cash $17,000 Land ? Notes payable $48,000 Retained earnings

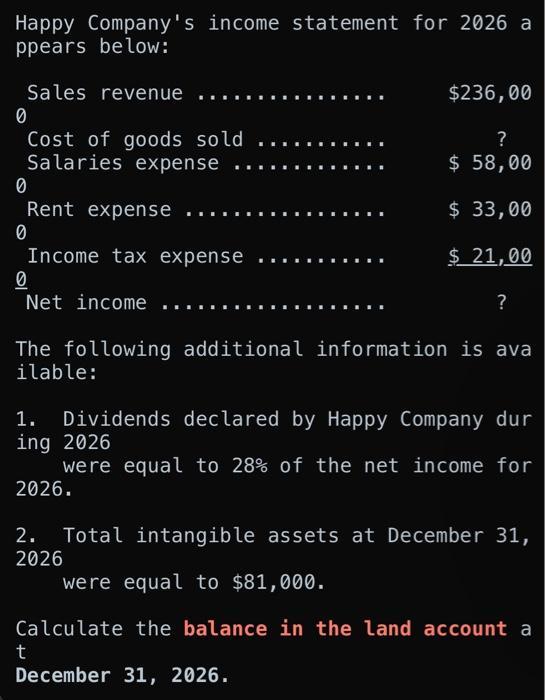

The following accounts were taken from Happ y Company's balance sheets for 2026: December 31 Cash $17,000 Land ? Notes payable $48,000 Retained earnings $51,000 Supplies $19,000 Accounts payable $23,000 Equipment $36,000 Patent ? Accounts receivable $43,000 Common stock $97,000 Mortgage payable $81,000 Copyright $32,000 Inventory $65,000 January 1 $20,000 $57,000 $36,000 $33,000 $11,000 $42,000 $28,000 $18,000 $56,000 $83,000 $77,000 $32,000 $49,000 Happy Company's income statement for 2026 a ppears below: Sales revenue 0 Cost of goods sold Salaries expense 0 Rent expense 0 Income tax expense 0 Net income $236,00 ? $ 58,00 $ 33,00 $ 21,00 ? The following additional information is ava ilable: 1. Dividends declared by Happy Company dur ing 2026 were equal to 28% of the net income for 2026. 2. Total intangible assets at December 31, 2026 were equal to $81,000. Calculate the balance in the land account a t December 31, 2026.

Step by Step Solution

3.46 Rating (175 Votes )

There are 3 Steps involved in it

To determine the missing values in Happy Companys balance sheets for 2026 we can use the fundamental ... View full answer

Get step-by-step solutions from verified subject matter experts