Question: Suppose that Boeing Corporation exported a 747 to British Airways and billed 10 million payable in one year. The money market interest rates and

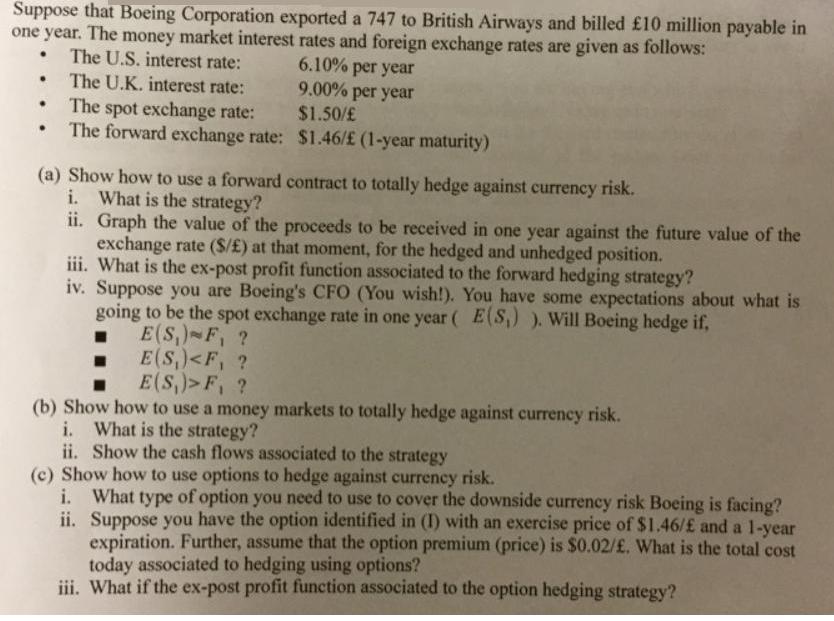

Suppose that Boeing Corporation exported a 747 to British Airways and billed 10 million payable in one year. The money market interest rates and foreign exchange rates are given as follows: The U.S. interest rate: 6.10% per year 9.00% per year The U.K. interest rate: . The spot exchange rate: The forward exchange rate: $1.50/ $1.46/ (1-year maturity) (a) Show how to use a forward contract to totally hedge against currency risk. i. What is the strategy? ii. Graph the value of the proceeds to be received in one year against the future value of the exchange rate ($/) at that moment, for the hedged and unhedged position. iii. What is the ex-post profit function associated to the forward hedging strategy? iv. Suppose you are Boeing's CFO (You wish!). You have some expectations about what is going to be the spot exchange rate in one year ( E(S,) ). Will Boeing hedge if, E(S) F, ? E(S) F, ? (b) Show how to use a money markets to totally hedge against currency risk. i. What is the strategy? ii. Show the cash flows associated to the strategy (c) Show how to use options to hedge against currency risk. i. What type of option you need to use to cover the downside currency risk Boeing is facing? ii. Suppose you have the option identified in (1) with an exercise price of $1.46/ and a 1-year expiration. Further, assume that the option premium (price) is $0.02/. What is the total cost today associated to hedging using options? iii. What if the ex-post profit function associated to the option hedging strategy?

Step by Step Solution

3.50 Rating (177 Votes )

There are 3 Steps involved in it

To address the questions lets break them down stepbystep a Using a Forward Contract to Hedge i What is the strategy Strategy Boeing can enter into a f... View full answer

Get step-by-step solutions from verified subject matter experts