Question: Sloane is an insurance agent and he meets with his client, Darcy, for an annual review. Darcy purchased a G2 whole life insurance policy

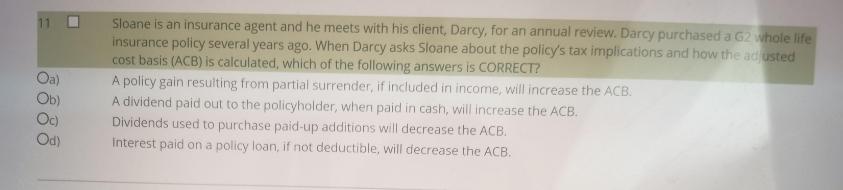

Sloane is an insurance agent and he meets with his client, Darcy, for an annual review. Darcy purchased a G2 whole life insurance policy several years ago. When Darcy asks Sloane about the policy's tax implications and how the ad usted cost basis (ACB) is calculated, which of the following answers is CORRECT? A policy gain resulting from partial surrender, if included in income, will increase the ACB. A dividend paid out to the policyholder, when paid in cash, will increase the ACB. Dividends used to purchase paid-up additions will decrease the ACB. Oa) Ob) Oc) Od) interest paid on a policy loan, if not deductible, will decrease the ACB. 8888

Step by Step Solution

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Answer b A dividend paid out to the policyholder w... View full answer

Get step-by-step solutions from verified subject matter experts