Question: Guillaume's son lives with a severe mental illness and Guillaume opens a Registered Disability Savings Plan (RDSP) for him. Guillaume makes contributions of $150

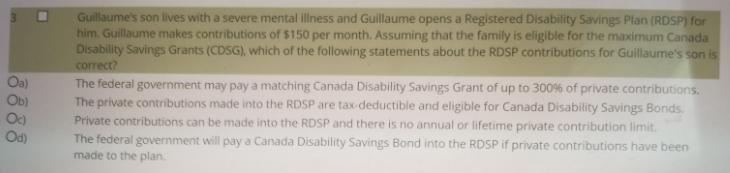

Guillaume's son lives with a severe mental illness and Guillaume opens a Registered Disability Savings Plan (RDSP) for him. Guillaume makes contributions of $150 per month. Assuming that the family is eligible for the maximum Canada Disability Savings Grants (CDSG), which of the following statements about the RDSP contributions for Guillaume's son is correct? Oa) Ob) The federal government may pay a matching Canada Disability Savings Grant of up to 300% of private contributions. The private contributions made into the RDSP are tax-deductible and eligible for Canada Disability Savings Bonds. Private contributions can be made into the RDSP and there is no annual or lifetime private contribution limit. The federal government will pay a Canada Disability Savings Bond into the RDSP if private contributions have been made to the plan Od) 8888

Step by Step Solution

3.54 Rating (151 Votes )

There are 3 Steps involved in it

Option B is correct Priv... View full answer

Get step-by-step solutions from verified subject matter experts