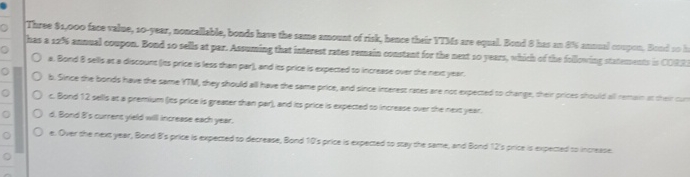

Question: 0 0 Three $1,000 face value, so-year, noncallable, bonds have the same amount of risk, hence their YTMs are equal. Bond 8 has an

0 0 Three $1,000 face value, so-year, noncallable, bonds have the same amount of risk, hence their YTMs are equal. Bond 8 has an 8% annual coupon, Bond so ha has a 12% annual coupon. Bond so sells at par. Assuming that interest rates remain constant for the next so years, which of the following statements is CORRE OaBond 8 sells at a discount es price is less than parl, and its price is expected to increase over the next year. b. Since the bonds have the same YTM, they should all have the same price, and since interest rates are not expected to change, their prices should all rem OcBond 12 sells at a premium its price is greater than par), and its price is expected to increase over the next year. Od. Bond 8's current yield will increase each year. e. Over the next year, Bond B's price is expected to decrease, Bond 10's price is expected to stay the same, and Bond 12's price is expected to increase

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts