Question: ++ 0 1 2 3 4 5 60 7 8 9 10 Sales figures 100 100 100 100 100 100 100 100 100 100

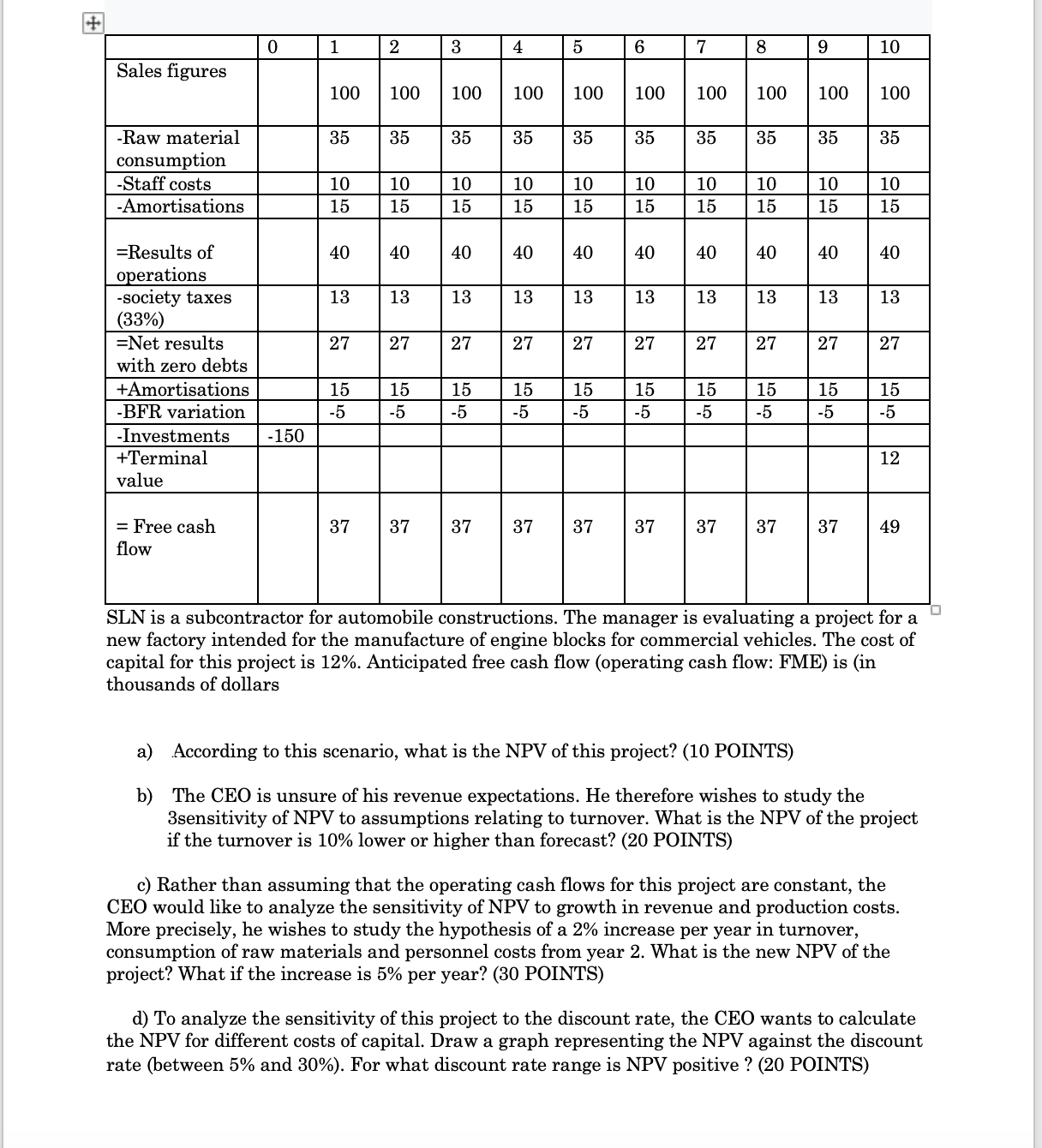

++ 0 1 2 3 4 5 60 7 8 9 10 Sales figures 100 100 100 100 100 100 100 100 100 100 -Raw material 35 35 35 35 35 35 35 35 35 35 consumption -Staff costs 10 10 10 -Amortisations 15 15 15 15 15 10 10 10 10 15 15 15 15 15 10 10 15 15 GO 10 15 =Results of 40 40 10 40 40 40 40 40 40 40 40 operations -society taxes 13 13 13 13 13 13 13 13 13 13 (33%) =Net results 27 27 27 27 27 27 27 27 27 27 with zero debts | +Amortisations 15 15 15 15 -BFR variation -5 -5 -5 -5 55 55 15 15 -5 -5 -5 155 15 15 15 15 -5 50 -5 -5 -Investments -150 +Terminal value 12 = Free cash 37 37 37 37 37 37 37 37 37 49 flow SLN is a subcontractor for automobile constructions. The manager is evaluating a project for a new factory intended for the manufacture of engine blocks for commercial vehicles. The cost of capital for this project is 12%. Anticipated free cash flow (operating cash flow: FME) is (in thousands of dollars a) According to this scenario, what is the NPV of this project? (10 POINTS) b) The CEO is unsure of his revenue expectations. He therefore wishes to study the 3sensitivity of NPV to assumptions relating to turnover. What is the NPV of the project if the turnover is 10% lower or higher than forecast? (20 POINTS) c) Rather than assuming that the operating cash flows for this project are constant, the CEO would like to analyze the sensitivity of NPV to growth in revenue and production costs. More precisely, he wishes to study the hypothesis of a 2% increase per year in turnover, consumption of raw materials and personnel costs from year 2. What is the new NPV of the project? What if the increase is 5% per year? (30 POINTS) d) To analyze the sensitivity of this project to the discount rate, the CEO wants to calculate the NPV for different costs of capital. Draw a graph representing the NPV against the discount rate (between 5% and 30%). For what discount rate range is NPV positive? (20 POINTS)

Step by Step Solution

There are 3 Steps involved in it

Answer To calculate the NPV of the project and address the CEOs inquiries we can use the following i... View full answer

Get step-by-step solutions from verified subject matter experts