Question: 0 1 3 Tutor.com is considering a plan to develop an online finance tutoring package that has the after-tax cash flow projections shown below. One

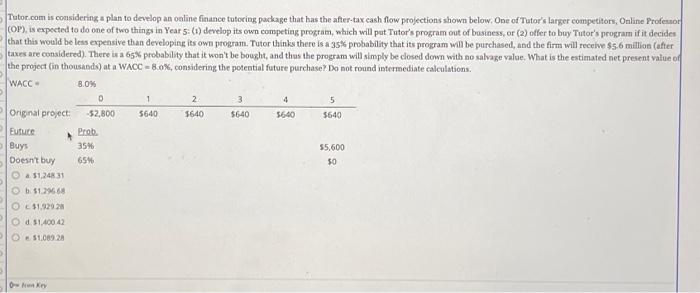

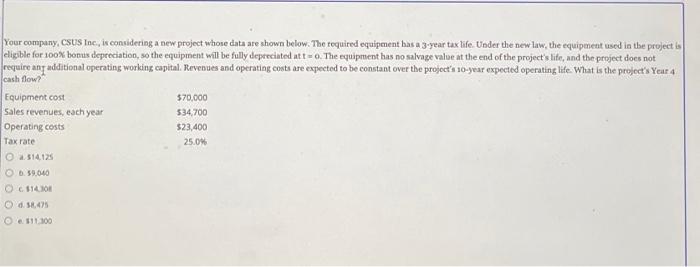

0 1 3 Tutor.com is considering a plan to develop an online finance tutoring package that has the after-tax cash flow projections shown below. One of Tutor's larger competitors, Online Professor COP), is expected to do one of two things in Year 5: (1) develop its own competing program, which will put Tutor's program out of business, or () offer to buy Tutor's program if it decides that this would be less expensive than developing its own program. Tutor thinks there is a 35% probability that its program will be purchased, and the firm will receive $5.6 million (after taxes are considered). There is a 65% probability that it won't be bought, and thus the program will simply be closed down with no salvage value. What is the estimated net present value of the project (in thousands) at a WACC -8.0%, considering the potential future purchase? Do not round intermediate calculations. WACC - 8.0% 2 4 5 Orignal project -52,800 5640 5640 5640 5640 5640 Euture Prob Buys 35% 55,600 Doesn't buy 65% 50 4 $1,2431 51.266 51.9292 d51.400.42 PO 51.089 21 0 Your company, CSUS Inc., is considering a new project whose data are shown below. The required equipment has a 3-year tax life Under the new law, the equipment used in the project is eligible for 100% bonus depreciation, so the equipment will be fully depreciated at to. The equipment has no salvage value at the end of the project's life, and the project does not require any additional operating working capital Revenues and operating costs are expected to be constant over the project's 10-year expected operating life. What is the project's Year 4 Icash flow" $70,000 534 700 523,400 25.0W Equipment cost Sales revenues, each year Operating costs Tax rate @2514125 6.39,040 OCH 58.478 111.300

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts