Question: 0 1 4 8 7. (5 points) Projects A and B met the requirements of NPV and minimum ROR. One did incremental analysis for project

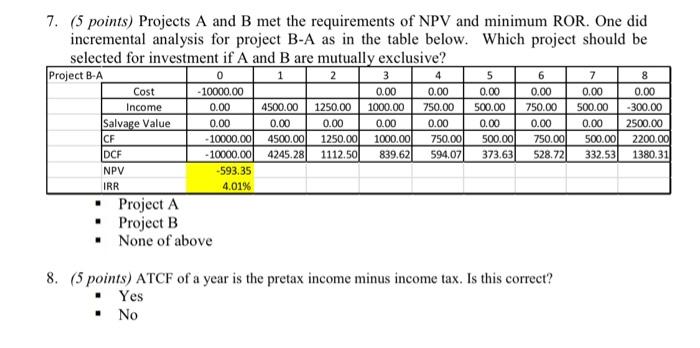

0 1 4 8 7. (5 points) Projects A and B met the requirements of NPV and minimum ROR. One did incremental analysis for project B-A as in the table below. Which project should be selected for investment if A and B are mutually exclusive? Project B-A 23 - 10000.00 0.00 0.00 0.00 4500.00 1250.00 1000.00 750.00 500.00 750.00 500.00 Salvage Value - 10000.00 500.00 500.00 - 10000.00 4245.28 839.62 -593.35 5 0.00 6 0.00 7 0.00 Cost Income 0.00 0.00 0.00 0.00 0.00 4500.00 0.00 1250.000 1112.50 0.00 1000.00 0.00 750.00 594.07 0.00 750.00 528.72 -300.00 2500.00 2200.00 1380.31 373.63 332.53 CF DCF NPV IRR 4.01% . Project A . Project B - None of above 8. (5 points) ATCF of a year is the pretax income minus income tax. Is this correct? Yes No

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts