Question: 0 1 6 8 9 10 Chapter 9 4) Suppose you are a financial manager for the Shah Corporation and trying to decide between the

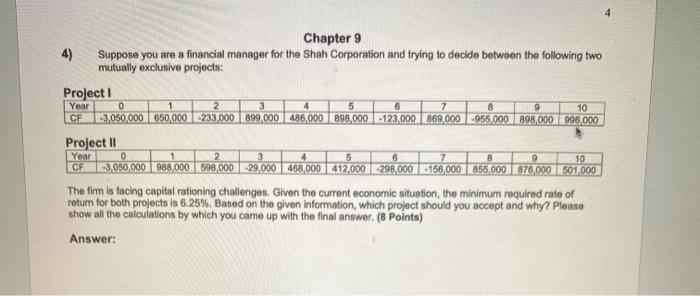

0 1 6 8 9 10 Chapter 9 4) Suppose you are a financial manager for the Shah Corporation and trying to decide between the following two mutually exclusive projects: Project! Year 2 3 5 CF -3,050.000 650,000.233.000 899,000 486,000 898,000.123,000 869,000,955.000898.000996,000 Project 11 Year 0 2 3 4 5 6 B 9 10 CF 3,050,000088,000 508,000 -29,000 488,000 412.000-298,000-166,000 865,000 876,000 601,000 The firm is facing capital rationing challenges. Given the current economic situation, the minimum required rate of retum for both projects is 6.25%. Based on the given information, which project should you accept and why? Please show all the calculations by which you came up with the final answer. (8 Points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts