Question: 0 1 Part B - Financial Analysis Short Answer (67 pts) 2 3 1. GAME is funded by the following types of capital: 4 Common

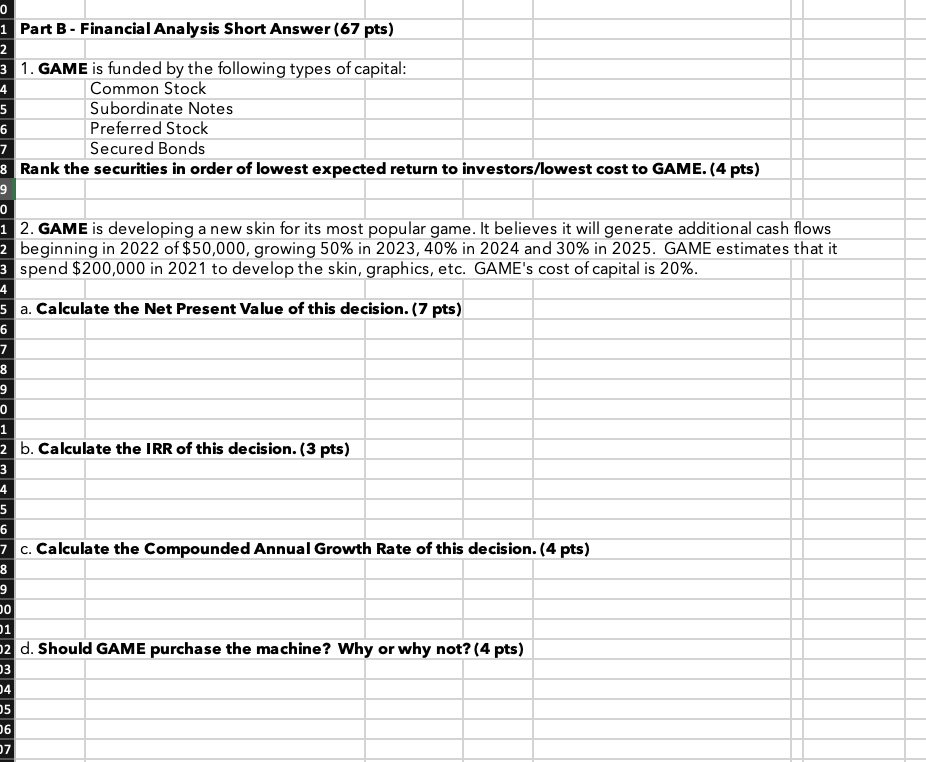

0 1 Part B - Financial Analysis Short Answer (67 pts) 2 3 1. GAME is funded by the following types of capital: 4 Common Stock 5 Subordinate Notes 6 Preferred Stock 7 Secured Bonds 8 Rank the securities in order of lowest expected return to investors/lowest cost to GAME.(4 pts) 9 0 1 2. GAME is developing a new skin for its most popular game. It believes it will generate additional cash flows 2 beginning in 2022 of $50,000, growing 50% in 2023, 40% in 2024 and 30% in 2025. GAME estimates that it 3 spend $200,000 in 2021 to develop the skin, graphics, etc. GAME's cost of capital is 20%. 4 5 a. Calculate the Net Present Value of this decision. (7 pts) 6 7 8 9 0 1 2 b. Calculate the IRR of this decision.(3 pts) 3 4 5 6 7 c. Calculate the Compounded Annual Growth Rate of this decision. (4 pts) 8 9 0 1 2 d. Should GAME purchase the machine? Why or why not? (4 pts) ouw N 7 0 1 Part B - Financial Analysis Short Answer (67 pts) 2 3 1. GAME is funded by the following types of capital: 4 Common Stock 5 Subordinate Notes 6 Preferred Stock 7 Secured Bonds 8 Rank the securities in order of lowest expected return to investors/lowest cost to GAME.(4 pts) 9 0 1 2. GAME is developing a new skin for its most popular game. It believes it will generate additional cash flows 2 beginning in 2022 of $50,000, growing 50% in 2023, 40% in 2024 and 30% in 2025. GAME estimates that it 3 spend $200,000 in 2021 to develop the skin, graphics, etc. GAME's cost of capital is 20%. 4 5 a. Calculate the Net Present Value of this decision. (7 pts) 6 7 8 9 0 1 2 b. Calculate the IRR of this decision.(3 pts) 3 4 5 6 7 c. Calculate the Compounded Annual Growth Rate of this decision. (4 pts) 8 9 0 1 2 d. Should GAME purchase the machine? Why or why not? (4 pts) ouw N 7

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts