Question: 0 . 5 points Return to question Item 2 1 Salt and Mineral ( SAM ) began 2 0 2 4 with 2 5 0

points

Return to question

Item

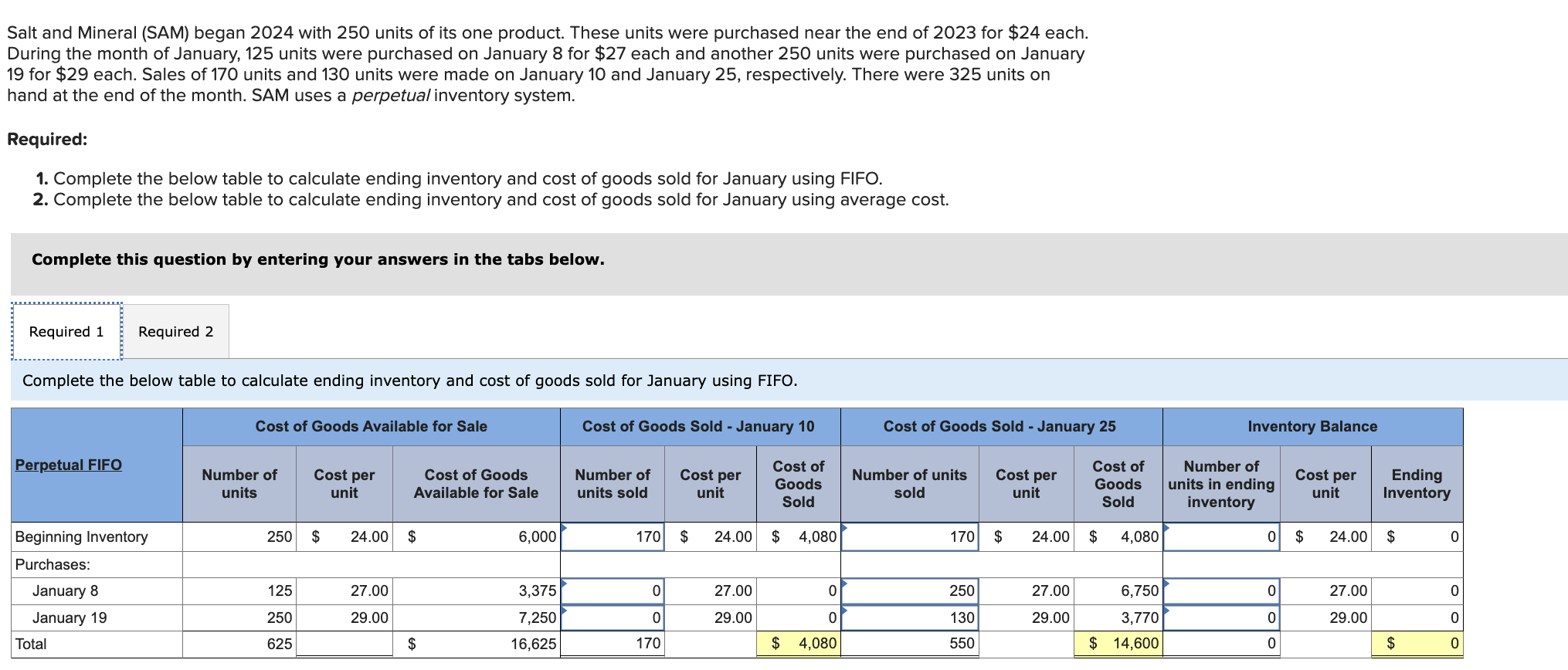

Salt and Mineral SAM began with units of its one product. These units were purchased near the end of for $ each. During the month of January, units were purchased on January for $ each and another units were purchased on January for $ each. Sales of units and units were made on January and January respectively. There were units on hand at the end of the month. SAM uses a perpetual inventory system.

Required:

Complete the below table to calculate ending inventory and cost of goods sold for January using FIFO.

Complete the below table to calculate ending inventory and cost of goods sold for January using average cost. Salt and Mineral SAM began with units of its one product. These units were purchased near the end of for $ each. During the month of January, units were purchased on January for $ each and another units were purchased on January for $ each. Sales of units and units were made on January and January respectively. There were units on hand at the end of the month. SAM uses a perpetual inventory system.

Required:

Complete the below table to calculate ending inventory and cost of goods sold for January using FIFO.

Complete the below table to calculate ending inventory and cost of goods sold for January using average cost.

Complete this question by entering your answers in the tabs below.

Complete the below table to calculate ending inventory and cost of goods sold for January using FIFO. Salt and Mineral SAM began with units of its one product. These units were purchased near the end of for $ each. During the month of January, units were purchased on January for $ each and another units were purchased on January for $ each. Sales of units and units were made on January and January respectively. There were units on hand at the end of the month. SAM uses a perpetual inventory system.

Required:

Complete the below table to calculate ending inventory and cost of goods sold for January using FIFO.

Complete the below table to calculate ending inventory and cost of goods sold for January using average cost.

Complete this question by entering your answers in the tabs below.

Required

Required

Complete the below table to calculate ending inventory and cost of goods sold for January using average cost

Note: Round cost per unit to decimal places. Enter inventory reductions from sales as negative numbers.

begintabularccccccccccc

hline multirowbPerpetual Average & multicolumncInventory on hand & multicolumncCost of Goods Sold

hline & Number of units & multicolumnlCost per unit & multicolumnrInventory Value & Number of units sold & & per & &

hline Beginning Inventory & & $ & & $ & & & & & &

hline Purchase January & & & & & & & & & &

hline Subtotal Average Cost & & & & & & & & & &

hline Sale January & & & & & & & $ & & $ &

hline Subtotal Average Cost & & & & & & & & & &

hline Purchase January & & & & & & & & & &

hline Subtotal Average Cost & & & & & & & & & &

hline Sale January & & & & & & & & & &

hline Total & & & & $ & & & & & $ &

hline

endtabular

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock