Question: 0 6 : 2 6 4 G Assessment 1 Question 8 Not yet answered Marked out of 1 . 0 0 Reds, a UK resident

:

G

Assessment

Question

Not yet answered

Marked out of

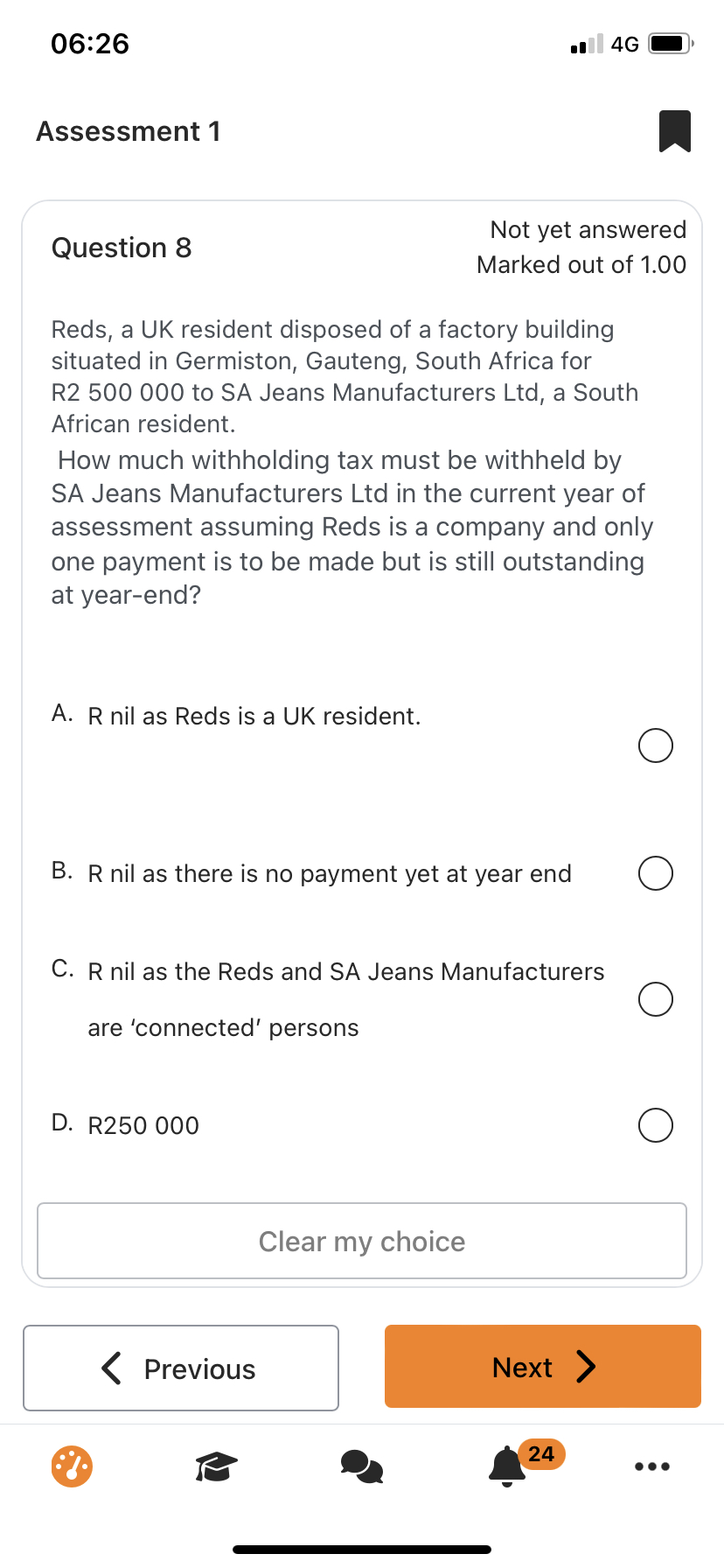

Reds, a UK resident disposed of a factory building situated in Germiston, Gauteng, South Africa for R to SA Jeans Manufacturers Ltd a South African resident.

How much withholding tax must be withheld by SA Jeans Manufacturers Ltd in the current year of assessment assuming Reds is a company and only one payment is to be made but is still outstanding at yearend?

A R nil as Reds is a UK resident.

B R nil as there is no payment yet at year end

C R nil as the Reds and SA Jeans Manufacturers are 'connected' persons

D R

Clear my choice

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock