Question: 0 9 . 0 3 - PR 0 0 8 Specialized production equipment is purchased for ( $ 1 2 5 , 0

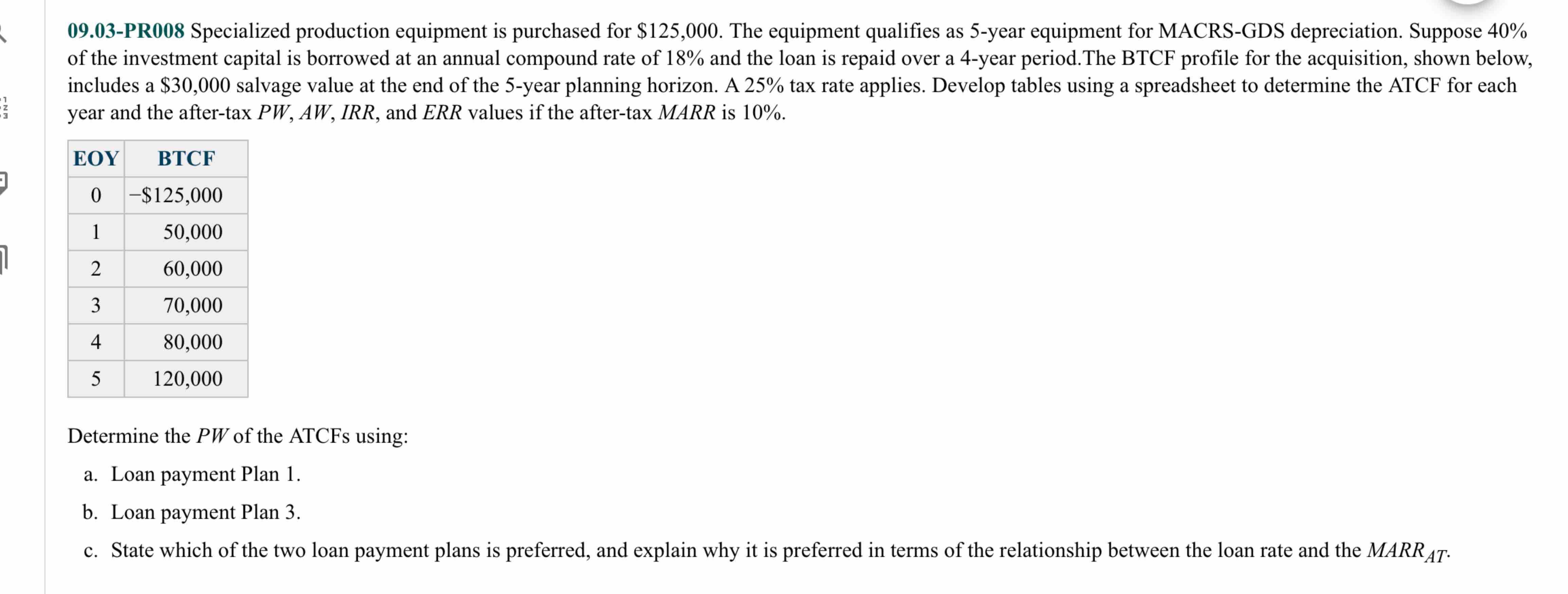

PR Specialized production equipment is purchased for $ The equipment qualifies as year equipment for MACRSGDS depreciation. Suppose of the investment capital is borrowed at an annual compound rate of and the loan is repaid over a year period.The BTCF profile for the acquisition, shown below, includes a $ salvage value at the end of the year planning horizon. A tax rate applies. Develop tables using a spreadsheet to determine the ATCF for each year and the aftertax P W A W I R R and E R R values if the aftertax M A R R is Determine the P W of the ATCFs using: a Loan payment Plan b Loan payment Plan c State which of the two loan payment plans is preferred, and explain why it is preferred in terms of the relationship between the loan rate and the M A R RA T

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock