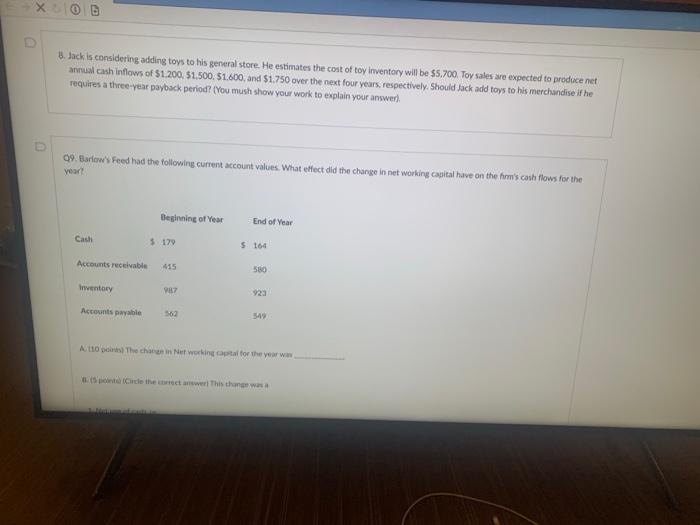

Question: 0 B. Jack is considering adding toys to his general store. He estimates the cost of toy Inventory will be 55.700 Toy sales are expected

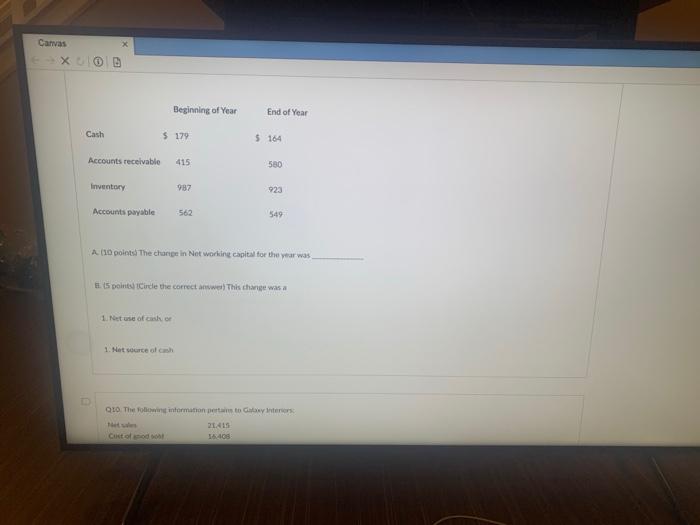

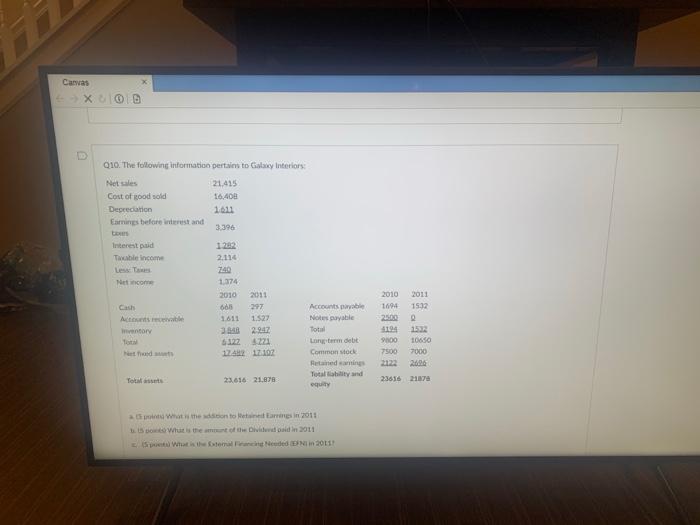

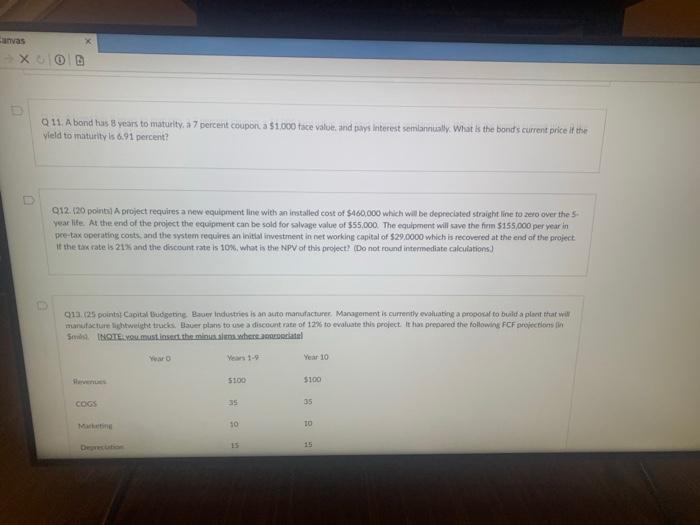

0 B. Jack is considering adding toys to his general store. He estimates the cost of toy Inventory will be 55.700 Toy sales are expected to produce net anual cash inflows of $1.200, $1.500.51.500, and $1.750 over the next four years, respectively. Should Jack add toys to his merchandise if he requires a three-year payback period? You mush show your work to explain your answer 09. Barlow's Feed had the following current account values. What effect did the change in net working capital have on the firm's cash flows for the year Beginning of Year End of Year Cash $ 179 $ 164 Accounts receivable 580 Inventory 987 923 Accounts payable 562 549 A 110 points the chain Networking cart for the year Birde the corect wel This throw Canvas XD Beginning of Year End of Year Cash $ 179 $ 164 Accounts receivable 415 580 Inventory 987 923 Accounts payable 562 549 A 110 points. The change in Not working capital for the year was E. 15 points Circle the correct answer! This change was a 1. Netuse of cash or 1. Net source och QLO The following information or to Go interes 21415 16:43 Carwas XOD D Q10. The following information pertains to Galaxy Interiors Net als 21425 Cost of good sold 16.400 Depreciation 101 Earnings before interest and 3.396 Interest paid Table income 2.114 Metcon Cash 1374 2010 2011 665 297 1611 1.527 3348 2.947 5221 1742 17:10 entory Tata Accounts poble Notes payable Total Lugem debit Common stock Retained anings Totality and equity 2010 2011 1004 15:32 -25.000 4194 1532 9800 10650 75007000 2006 23616 21170 23.616 21.878 What the son to earn in 2011 What is the of the video baldin 2011 Wat is the strained in 2011 canvas X D 011. A bond has years to maturity. a 7 percent coupon, a $1.000 tace value and pays interest semiannually. What is the bonds current price if the Vield to maturity is 6.91 percent? Q12. (20 points project requires a new equipment line with an installed cost of $460,000 which will be depreciated straight line to zero over the 5- year lite. At the end of the project the equipment can be sold for salvage value of $55.000. The equipment will save the firm 5155.000 per year in pre-tax operating costs, and the system requires an initial investment in networking capital of $29.0000 which is recovered at the end of the project It the tax rate is 21% and the discount rate is 10%, what is the NPV of this project? (Do not round intermediate calculations) 13.25 pointe Capital Budgeting Bauer Industries is an auto manufacturer Management is currently evaluating a proposal to build a plot that w manufacture lightweight trucks Bauer plans to use a discount rate of 12% to evaluate this project. It has prepared the following FCF projections SINOTELOmstart the minimal Yao Year 10 $100 $100 COGS 35 35 Mind 10 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts