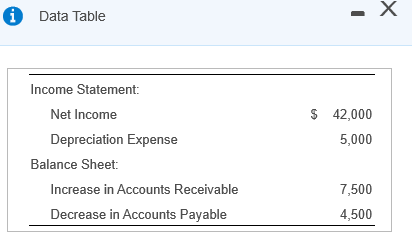

Question: 0 Data Table Income Statement: $ 42,000 5,000 Net Income Depreciation Expense Balance Sheet: Increase in Accounts Receivable Decrease in Accounts Payable 7,500 4,500 DCD

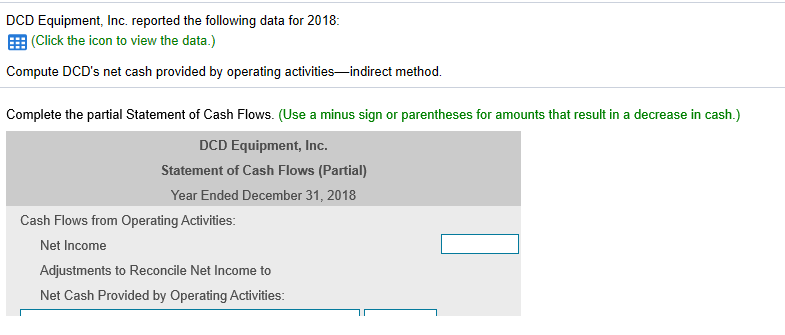

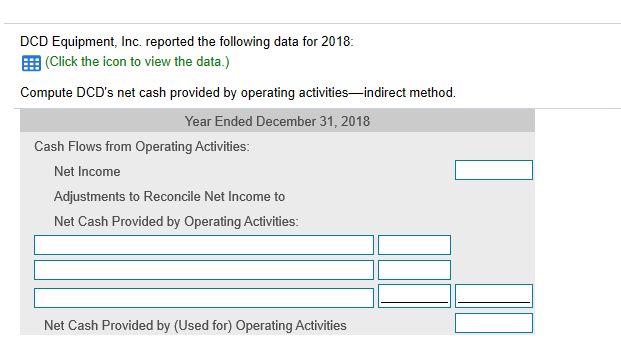

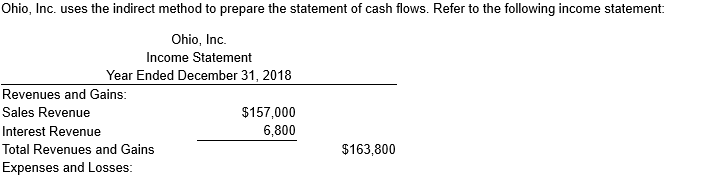

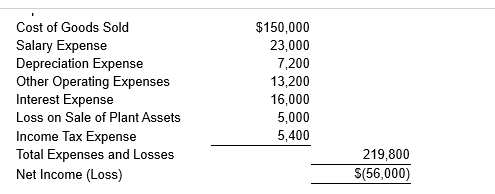

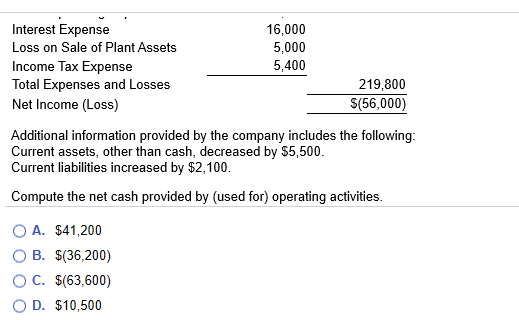

0 Data Table Income Statement: $ 42,000 5,000 Net Income Depreciation Expense Balance Sheet: Increase in Accounts Receivable Decrease in Accounts Payable 7,500 4,500 DCD Equipment, Inc. reported the following data for 2018 (Click the icon to view the data.) Compute DCD's net cash provided by operating activities-indirect method. Complete the partial Statement of Cash Flows. (Use a minus sign or parentheses for amounts that result in a decrease in cash.) DCD Equipment, Inc. Statement of Cash Flows (Partial) Year Ended December 31, 2018 Cash Flows from Operating Activities: Net Income Adjustments to Reconcile Net Income to Net Cash Provided by Operating Activities: DCD Equipment, Inc. reported the following data for 2018: .: (Click the icon to view the data.) Compute DCD's net cash provided by operating activitiesindirect method. Year Ended December 31, 2018 Cash Flows from Operating Activities: Net Income Adjustments to Reconcile Net Income to Net Cash Provided by Operating Activities: Net Cash Provided by (Used for) Operating Activities Ohio, Inc. uses the indirect method to prepare the statement of cash flows. Refer to the following income statement: Ohio, Inc. Income Statement Year Ended December 31, 2018 Revenues and Gains: Sales Revenue $157,000 Interest Revenue 6,800 Total Revenues and Gains Expenses and Losses: $ 163,800 Cost of Goods Sold Salary Expense Depreciation Expense Other Operating Expenses Interest Expense Loss on Sale of Plant Assets Income Tax Expense Total Expenses and Losses Net Income (Loss) $150,000 23,000 7,200 13,200 16,000 5,000 5,400 219,800 S(56,000) Interest Expense Loss on Sale of Plant Assets Income Tax Expense Total Expenses and Losses Net Income (Loss) 16,000 5,000 5,400 219,800 S(56,000) Additional information provided by the company includes the following: Current assets, other than cash, decreased by $5,500. Current liabilities increased by $2,100. Compute the net cash provided by (used for) operating activities. O A. $41,200 O B. $(36,200) OC. $(63,600) OD. $10,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts