Question: (0) Drop down menu: 1: an actively managed concentrated stock-picking fund, a closet (or enhanced) index fund, a passive index fund. 2. differs, does not

(0)

Drop down menu:

1: an actively managed concentrated stock-picking fund, a closet (or enhanced) index fund, a passive index fund.

2. differs, does not differ.

3. an actively managed concentrated stock-picking fund, a closet (or enhanced) index fund, a passive index fund.

4. less , more

5. fewer, more

6. bigger smaller

7.an actively managed concentrated stock-picking fund, a closet (or enhanced) index fund, a passive index fund.

8. in number of these holdings, in the investment weights of those holdings, both in number of holdings and the investment weights of those holdings.

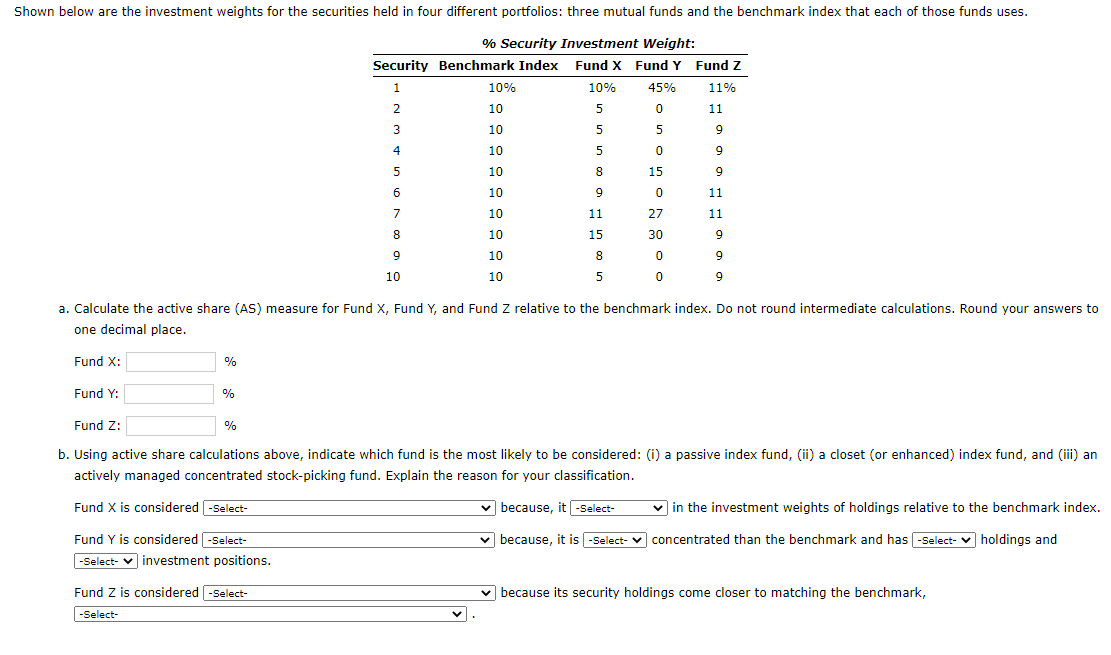

Fund Z: % b. Using active share calculations above, indicate which fund is the most likely to be considered: (i) a passive index fund, (ii) a closet (or enhanced) index fund, and (iii) an actively managed concentrated stock-picking fund. Explain the reason for your classification. Fund X is considered because, it in the investment weights of holdings relative to the benchmark index. Fund Y is considered because, it is concentrated than the benchmark and has holdings and investment positions. Fund Z is considered .] because its security holdings come closer to matching the benchmark

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts