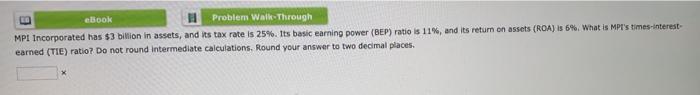

Question: 0 ebook Problem Walk-Through MPI Incorporated has $3 billion in assets, and its tax rate is 25%. Its basic earning power (BEP) ratio is 11%,

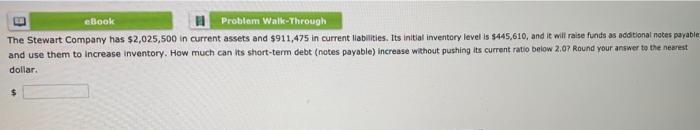

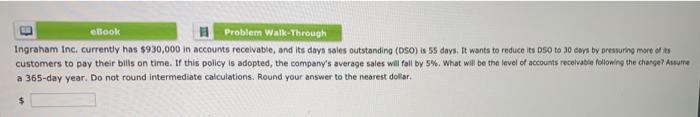

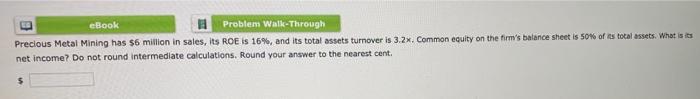

0 ebook Problem Walk-Through MPI Incorporated has $3 billion in assets, and its tax rate is 25%. Its basic earning power (BEP) ratio is 11%, and its return on assets (ROA) is 6%. What is MPI's times interest earned (TIE) ratio? Do not round Intermediate calculations. Round your answer to two decimal places eBook Problem Walk-Through The Stewart Company has $2,025,500 in current assets and $911,475 in current liabilities. Its initial inventory level is $445,610, and it will raise funds as additional notes payable and use them to increase inventory. How much can its short-term debt (notes payable) increase without pushing its current ratio below 2.07 Round your answer to the nearest dollar. $ eBook Problem Walk-Through Ingraham Inc. currently has $930,000 in accounts receivable, and its days sales outstanding (OSO) is 55 days. It wants to reduce its 050 to 30 days by pressuring more of a customers to pay their bills on time. If this policy is adopted, the company's average sales will fall by 5%. What will be the level of accounts receivable following the change? Assume a 365-day year. Do not round Intermediate calculations. Round your answer to the nearest dollar, $ LO eBook Problem Walk-Through Precious Metal Mining has $6 million in sales, Its ROE is 16%, and its total assets turnover is 3.2x. Common equity on the firm's balance sheet is 50% of its total assets. What is its net income? Do not round intermediate calculations. Round your answer to the nearest cent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts