Question: 0 HP 24 6 Saved Help Save& ExitSubmit 6 Check my work Santana Rey is considering the purchase of equipment for Business Solutions that would

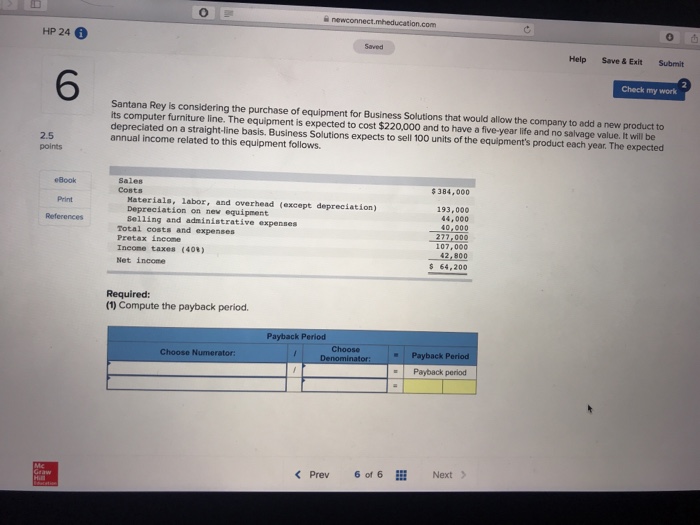

0 HP 24 6 Saved Help Save& ExitSubmit 6 Check my work Santana Rey is considering the purchase of equipment for Business Solutions that would allow the company to add a new product to its computer furniture line. The equipment is expected to cost $220,000 and to have a five-year life and no salvage value. It will be depreciated on a straight-line basis. Business Solutions expects to sell 100 units of the equipment's product each year The expected annual income related to this equipment follows 2.5 points Sales Costs eBook $384,000 Print Materials, labor, and overhead (except depreciation) 193,000 44,000 40,000 Depreciation on nev equipment Selling and administrative expenses Total cots and expenses Pretax income Income taxes (40%) Net income 277-000 107,000 2,800 s 64,200 Required: (1) Compute the payback period Payback Period Choose Choose Numerator: Payback Period Payback period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts