Question: 0 i https://bconline.browarc El Ian and Tami, a young couple with a child. live in a rented apartment. After taxes. Ian earns 338.180 per year

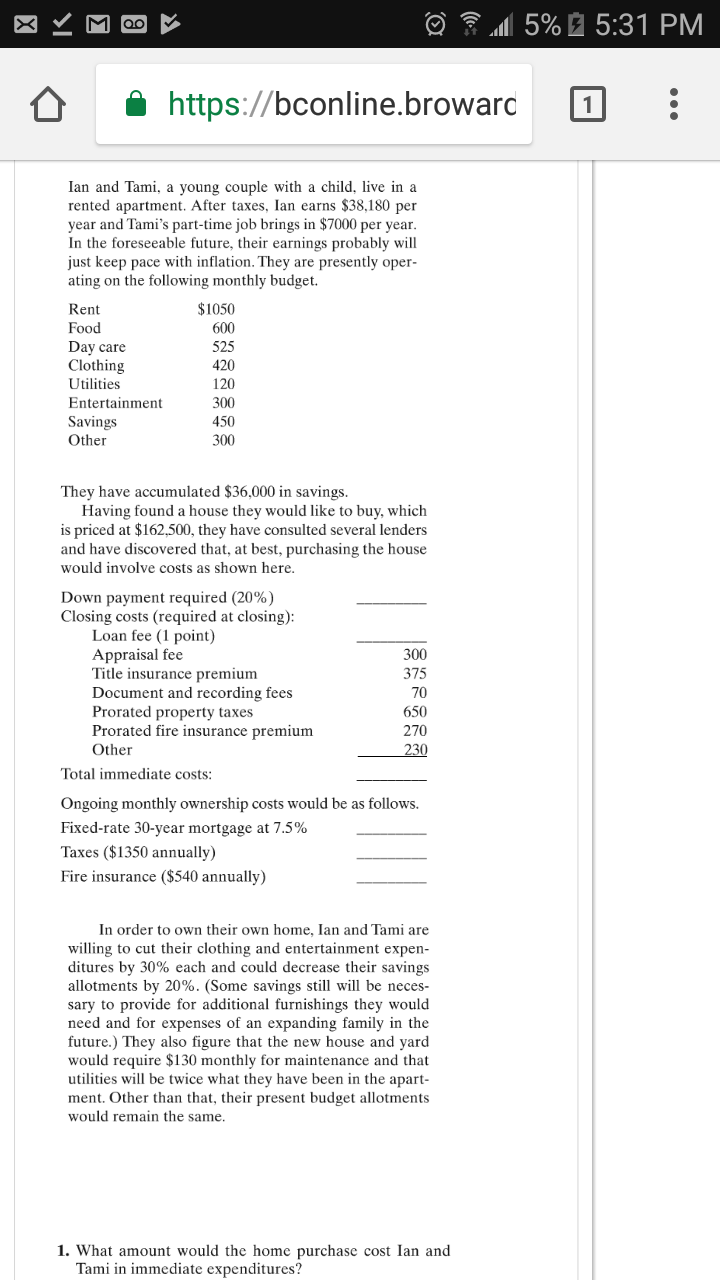

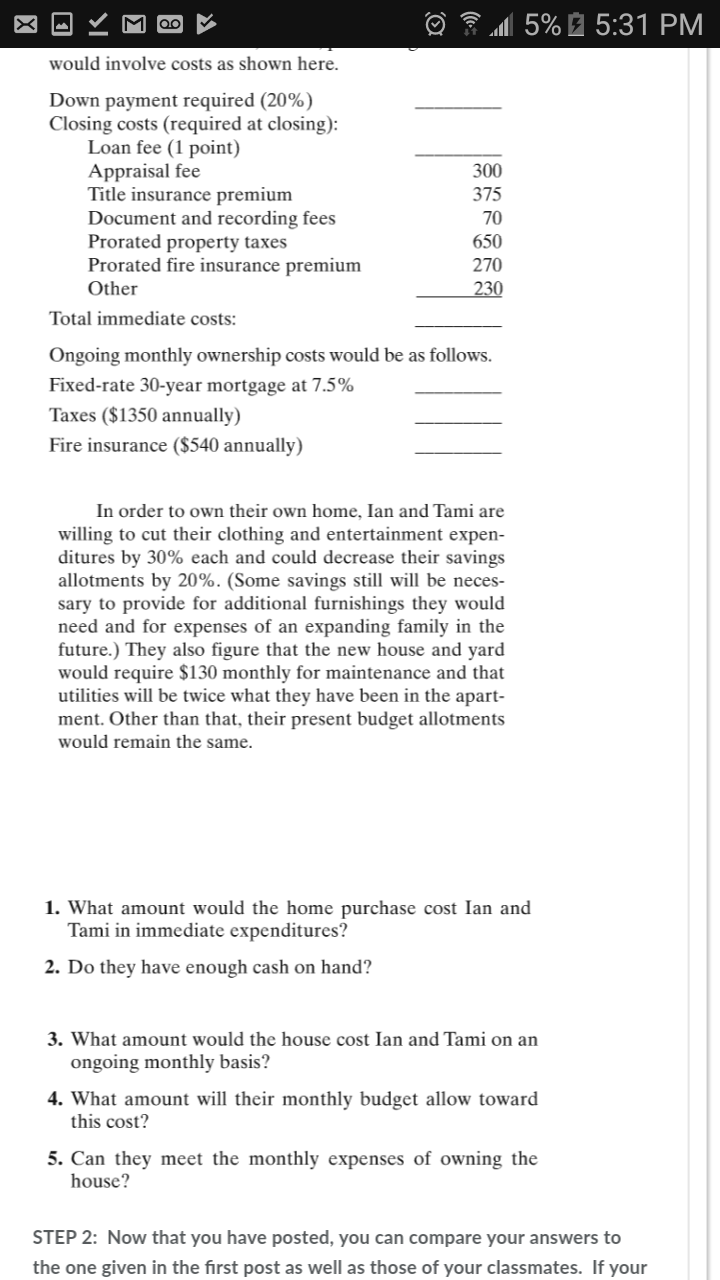

0 i https://bconline.browarc El Ian and Tami, a young couple with a child. live in a rented apartment. After taxes. Ian earns 338.180 per year and Tami's parttime job brings in $7000 per year. In the foreseeable future, their earnings probably will just keep pace with ination. They are presently oper- ating on the following monthly budget. Rent it [050 Food 600 Day care 525 Clothing 420 Utilities 120 Entertainment 300 Savings 450 Other 300 They have accumulated 336.000 in savings. Having found a house they would like to buy, which is priced at $162,500, they have consulted several lenders and have discovered that, at best. purchasing the house would involve costs as shown here. Down payment required (20%] Closing costs (required at closing): Loan fee (1 point} Appraisal fee 300 Title insurance premium 3?5 Document and recording fees 70 Prorated property taxes 650 Prorated fire insurance premium 270 Other 230 Total immediate costs: Ongoing monthly ownership costs would be as follows. Fixed-rate 30-year mortgage at 7.5 its Taxes [$1350 annually) Fire insurance {$540 annually] In order to own their own home, Ian and Tami are willing to out their clothing and entertainment expen ditures by 30% each and could decrease their savings allotments by 20%. (Some savings still will be neces- sary to provide for additional furnishings they would need and for expenses of an expanding family in the future.) They also gure that the new house and yard would require $130 monthly for maintenance and that utilities will be twice what they have been in the apart- ment. Other than that. their present budget allotments would remain the same. 1. What amount would the home purchase cost Ian and Tami in immediate expenditures? would involve costs as shown here. Down payment required (20%) Closing costs (required at closing}: Loan fee (1 point) Appraisal fee 300 Title insurance premium 375 Document and recording fees 7'0 Prorated property taxes 650 Prorated re insurance premium 2'30 Other 230 Total immediate costs: Ongoing monthly ownership costs would be as follows. Fixed-rate 30-year mortgage at 15% Taxes ($1359 annually) Ftre insurance ($540 annually) In order to own their own home, Ian and Tami are willing to cut their clothing and entertainment expen- ditures by 30% each and could decrease their savings allotments by 2.0%. (Some savings still will he neces- sary to provide for additional furnishings they would need and for expenses of an expanding family in the future.) They also gure that the new house and yard would require $130 monthly for maintenance and that utilities will be twice what they have been in the apart- ment. Other than that. their present budget allotments would remain the same. 1. What amount would the home purchase cost Ian and Tami in immediate expenditures? 2. Do they have enough cash on hand? 3. What amount would the house cost [an and Tami on an ongoing monthly basis? I. What amount will their monthly budget allow toward this cost? 5. Can they meet the monthly expenses of owning the house? STEP 2: Now that you have posted1 you can compare your answers to the one given in the rst post as well as those of your classmates. If your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts