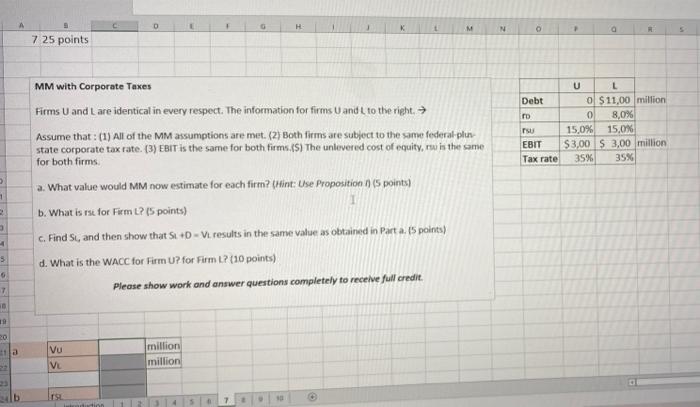

Question: 0 . M N a 7 25 points MM with Corporate Taxes Firms U and L are identical in every respect. The information for firms

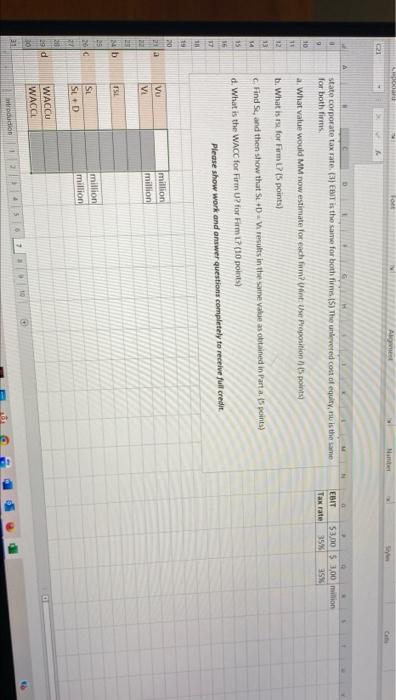

0 . M N a 7 25 points MM with Corporate Taxes Firms U and L are identical in every respect. The information for firms and to the right ole Debt ro SU EBIT Tax rate U L O $11,00 million 0 8,0% 15,0% 15.0% $3,00 $ 3,00 million 35% 35% 1 2 Assume that: (1) All of the MM assumptions are met. (2) Both firms are subject to the same federal-plus state corporate tax rate. (3) EBIT is the same for both firms.(s) The unlovered cost of equity.ru is the same for both firms a. What value would MM now estimate for each firm? (Hint: Use Proposition ! (5 points) b. What is rst for Firm L? (5 points) c. Find S, and then show that St +D - Vresults in the same vale as obtained in Part a. 15 points) d. What is the WACC for Firm Up for Firm L? (10 points) Please show work and answer questions completely to receive full credit. 1 5 6 7 20 la Vu VL million million b ITSE il Aloe state corporate tax rate (3) EBIT is the same for both firms 15) The univered cost of equity, nu is the same for both finis EBIT 53,005 3,00 million Tax rate 35% 35% 16 a. What value would MM now estimate for each fom? Vint: User Proposition points) 11 12 13 14 b. What is te for Firm Lt5 points) Finds, and then show that SL+D - mults in the same value as obtained in Parta. points) d. What is the WACC for Firm Up for Firm I? (10 points) Please show work and answer questions completely to receive full credit 35 16 IT 1 15 20 SS million million ub TSE 25 2010 SI SLD million million 29 d WACCU WACCI 31 rudion

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts