Question: 0 mathxl.com Content Do Homework - HW5 + 2020-2 ITF 312 - Financial Management 1 CEM_SMA_L AKKO : | 07/03/21 12:54 PM Homework: HW5 Save

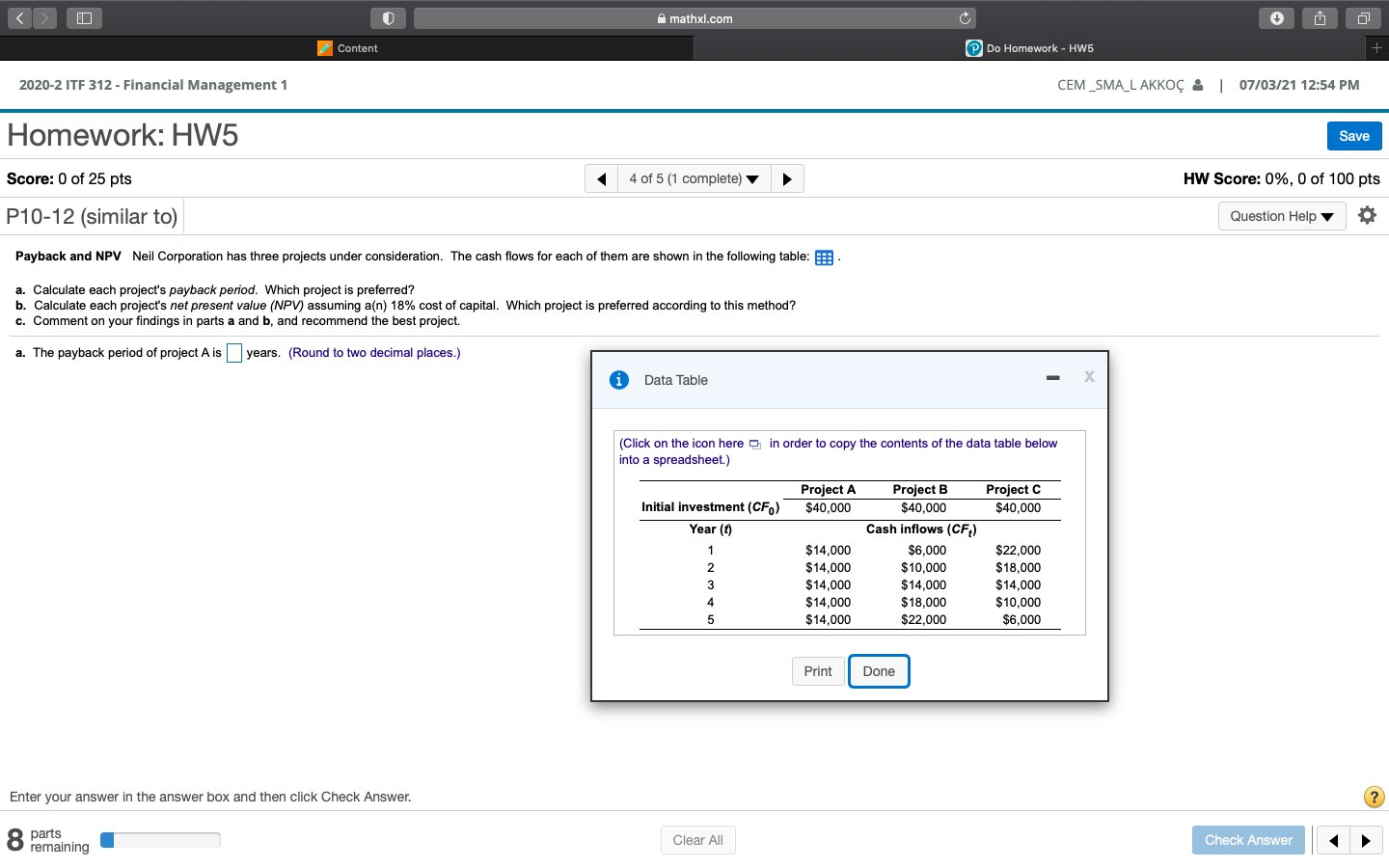

0 mathxl.com Content Do Homework - HW5 + 2020-2 ITF 312 - Financial Management 1 CEM_SMA_L AKKO : | 07/03/21 12:54 PM Homework: HW5 Save Score: 0 of 25 pts 4 of 5 (1 complete) HW Score: 0%, 0 of 100 pts P10-12 (similar to) Question Help Payback and NPV Neil Corporation has three projects under consideration. The cash flows for each of them are shown in the following table: a. Calculate each project's payback period. Which project is preferred? b. Calculate each project's net present value (NPV) assuming a(n) 18% cost of capital. Which project is preferred according to this method? C. Comment on your findings in parts a and b, and recommend the best project. a. The payback period of project Ais years. (Round to two decimal places.) Data Table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Project A $40,000 Initial investment (CF) Year (1) 1 2 3 4 $14.000 $14,000 $14,000 $14.000 $14,000 Project B Project C $40,000 $40,000 Cash inflows (CF) $6,000 $22.000 $10,000 $18,000 $14,000 $14,000 $18,000 $10,000 $22.000 $6,000 5 Print Done Done Enter your answer in the answer box and then click Check Answer. ? 8 parts remaining Clear All Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts