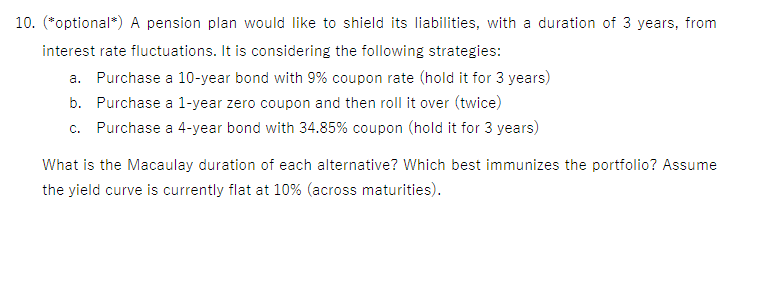

Question: 0. (*optional*) A pension plan would like to shield its liabilities, with a duration of 3 years, from interest rate fluctuations. It is considering the

0. (*optional*) A pension plan would like to shield its liabilities, with a duration of 3 years, from interest rate fluctuations. It is considering the following strategies: a. Purchase a 10 -year bond with 9% coupon rate (hold it for 3 years) b. Purchase a 1-year zero coupon and then roll it over (twice) c. Purchase a 4-year bond with 34.85% coupon (hold it for 3 years) What is the Macaulay duration of each alternative? Which best immunizes the portfolio? Assume the yield curve is currently flat at 10% (across maturities)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts