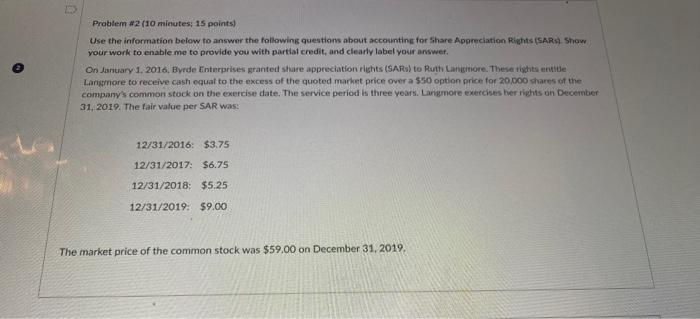

Question: 0 Problem #2 (10 minutes; 15 points) Use the information below to answer the following questions about accounting for Share Appreciation Rights (SARS). Show your

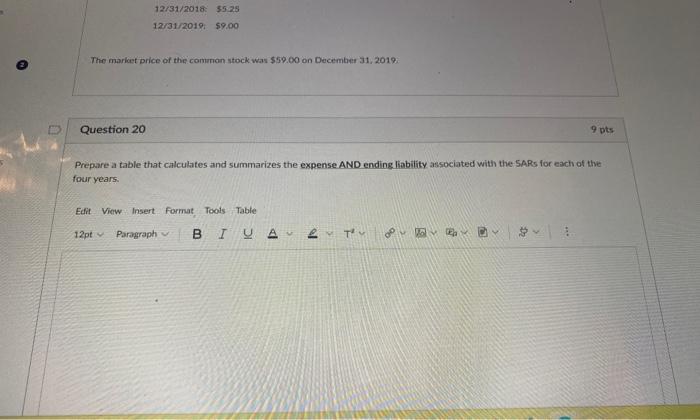

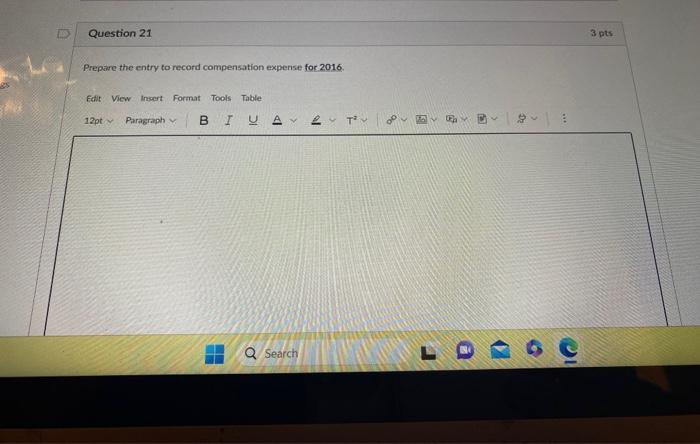

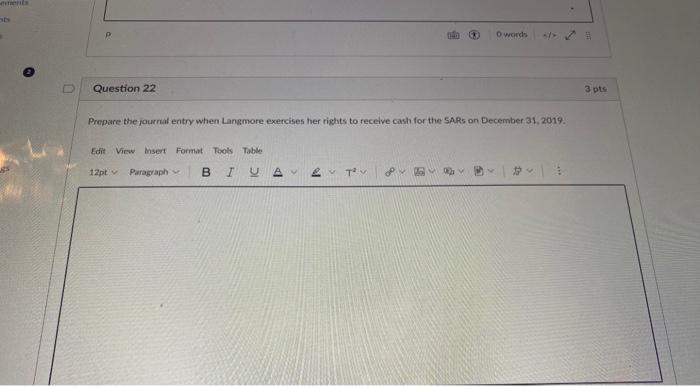

Question 21 3pts Prepare the entry to record compensation expense for 2016. Edit View insert Format Tools Table Problem #2 (10 minutes; 15 points) Use the information below to answer the following questions about accosinting for share Appreciation Rights (SARs). Show, your work to enable me to provide you with partial credit, and clearly labet your answer. On lantary 1, 2016, Bvrde Enterprises granted share appreciation rights (SARs) to Ruth Canginore. These tights entie Langmore to receive cash equat to the excess of the quoted market price over a $50 option price for 20,000 shares of the company's common stock on the exercise date, The service period is three yoars. Langmore exercises her rights on Decernber 31, 2019. The fair value per SAR was: 12/31/2016:12/31/2017:12/31/2018:12/31/2019:$3.75$6.75$5.25$9.00 The market price of the common stock was $59,00 on December 31,2019. 12/31/20185528 12/31/2019:59.00 (2) The marlet price of the common stock was $59.00 on December 31, 2019 Question 20 9 pts Prepare a table that calculates and summarizes the expense AND ending liability associated with the 5 ARs for each of the four years. Edit Viow Insert format Toots Table 2 Question 22 3 pts Prepare the journaf entry when Langmore exercises her rights to receive cash for the SARs on December 31, 2019. Edit View Mnsert Format Tools Table

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts