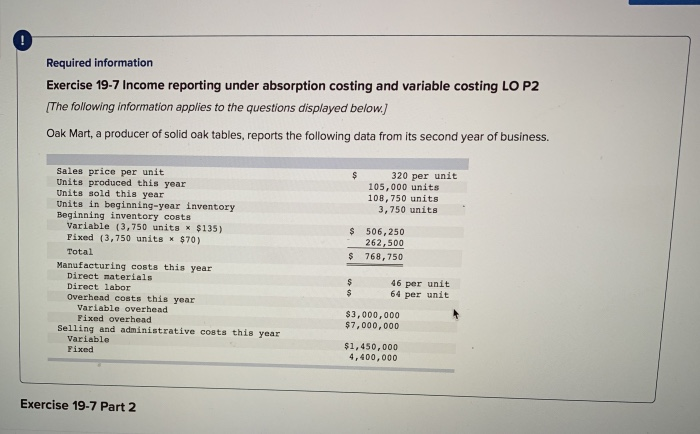

Question: 0 Required information Exercise 19-7 Income reporting under absorption costing and variable costing LO P2 The following information applies to the questions displayed below Oak

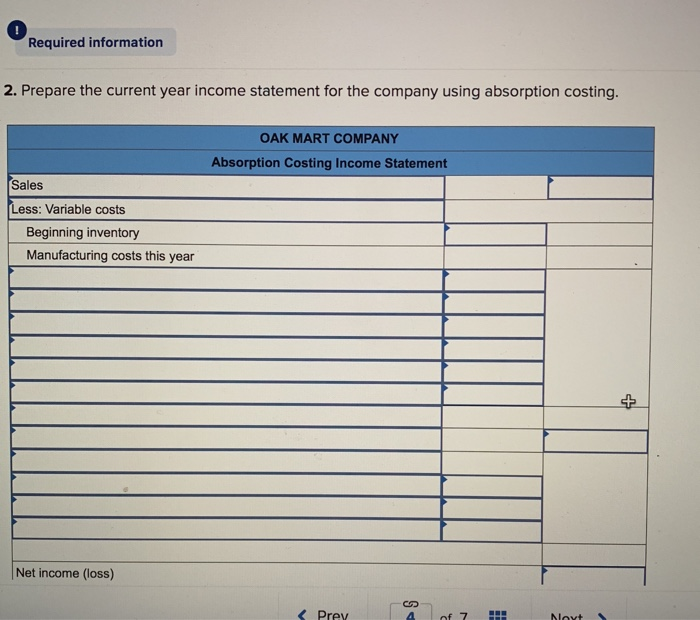

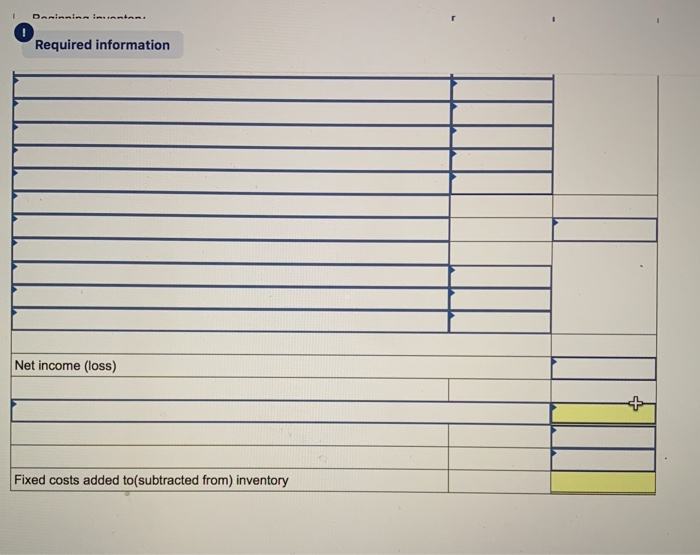

0 Required information Exercise 19-7 Income reporting under absorption costing and variable costing LO P2 The following information applies to the questions displayed below Oak Mart, a producer of solid oak tables, reports the following data from its second year of business. Sales price per unit Units produced this year Units sold this year Units in beginning-year inventory Beginning inventory costs $ 320 per unit 105,000 units 108,750 units 3,750 units Variable (3,750 units x $135) Pixed (3,750 units x $70) Total 506,250 262,500 $ 768,750 Manufacturing costs this year Direct naterials Direct labor overhead costs this year 46 per unit 64 per unit Variable overhead $3,000,000 $7,000, 000 Fixed overhead Selling and administrative costs this year Variable Fixed $1,450,000 4,400,000 Exercise 19-7 Part 2

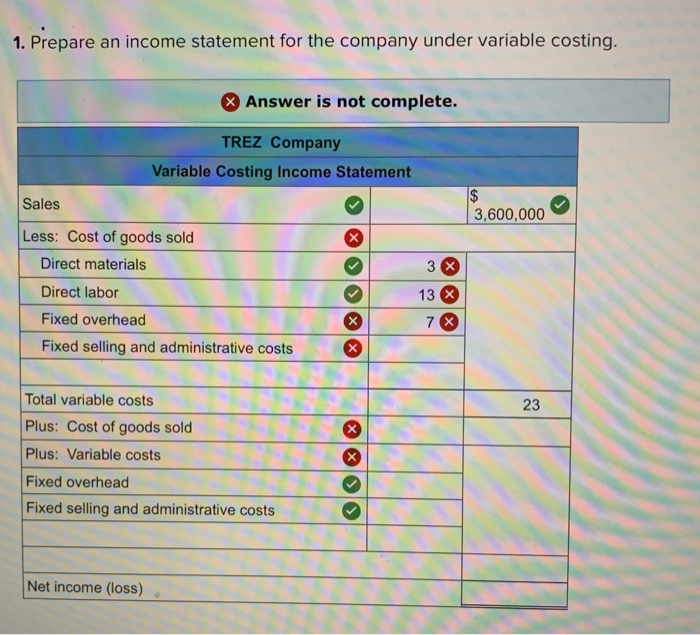

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts