Question: Prepare the 2021 income tax return for Slim Trim using the ProFile tax software program. Submission Instructions: Submit your assignment on eCentennial under Assignments-TSC

![1. T4 slip for Slim (see slip below for details. [T4 slip] 2. T5 Statement of Investment Income issued by the](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2022/05/628f73f89336d_CBEE4A7CB0FF4EDBA9EA8ED9421D9A69.jpeg)

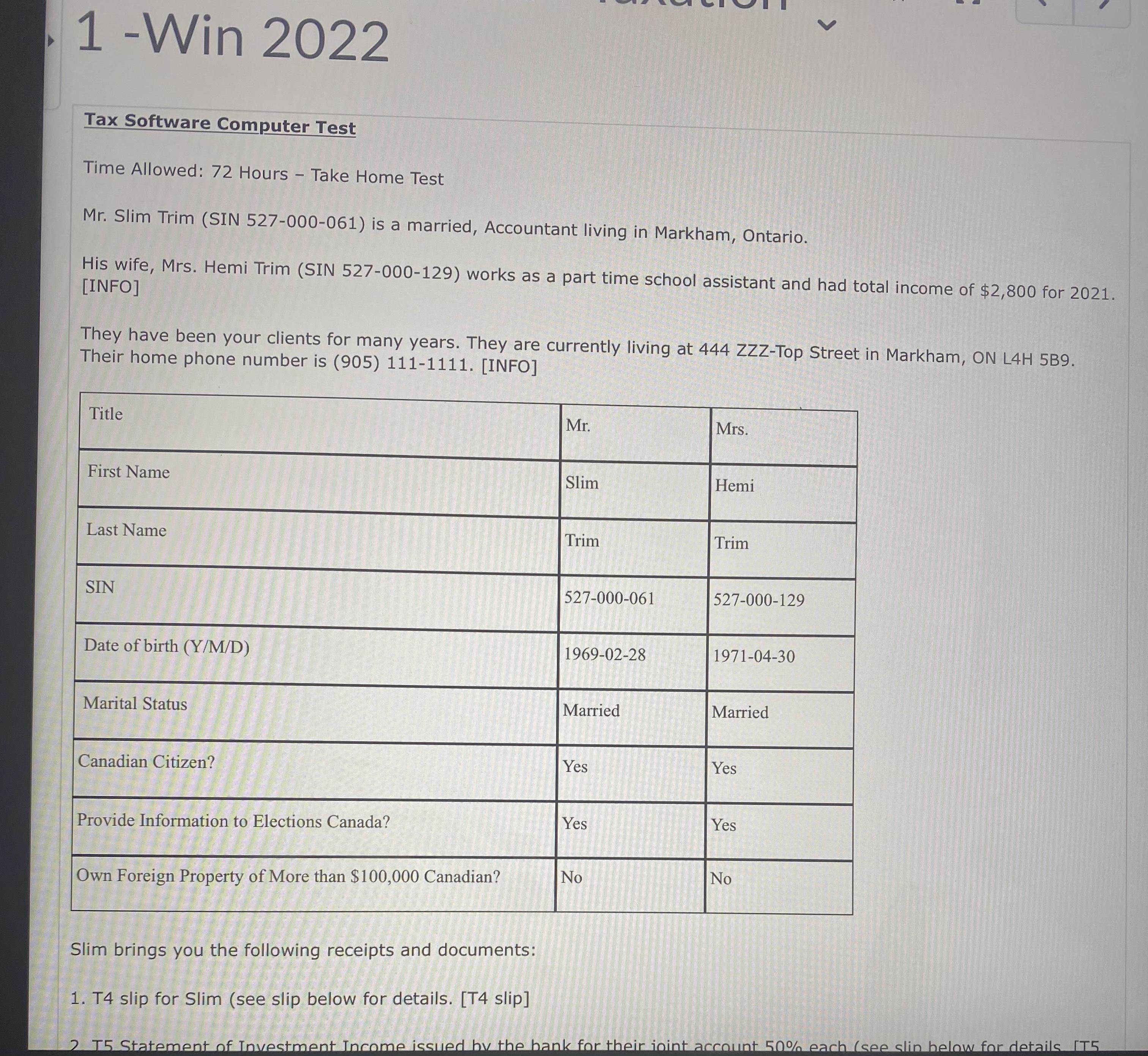

Prepare the 2021 income tax return for Slim Trim using the ProFile tax software program. Submission Instructions: Submit your assignment on eCentennial under "Assignments-TSC Test". Your submission should include: 1) The entire ProFile computer file (the file extension that ends.21T; for example PKumar.21T), and 2) Save the following completed forms from ProFile in PDF format and submit for marking: T1 Jacket & T1 Summary 1 -Win 2022 Tax Software Computer Test Time Allowed: 72 Hours - Take Home Test Mr. Slim Trim (SIN 527-000-061) is a married, Accountant living in Markham, Ontario. His wife, Mrs. Hemi Trim (SIN 527-000-129) works as a part time school assistant and had total income of $2,800 for 2021. [INFO] Title First Name Last Name They have been your clients for many years. They are currently living at 444 ZZZ-Top Street in Markham, ON L4H 5B9. Their home phone number is (905) 111-1111. [INFO] SIN Date of birth (Y/M/D) Marital Status Canadian Citizen? Provide Information to Elections Canada? Own Foreign Property of More than $100,000 Canadian? Slim brings you the following receipts and documents: 1. T4 slip for Slim (see slip below for details. [T4 slip] SA QUE ME A Mr. Slim -- Trim 527-000-061 HEA ASU 1969-02-28 Yes Married Yes No Mrs. Hemi Trim 527-000-129 1971-04-30 Married Yes C Yes No 2 T5 Statement of Investment Income issued by the bank for their joint account 50% each (see slin below for details [T5 1. T4 slip for Slim (see slip below for details. [T4 slip] 2. T5 Statement of Investment Income issued by the bank for their joint account 50% each (see slip below for details. [T5 slip] 3. A T2202A "Tuition and Enrollment Certificate" for himself from SRED College. It showed he was a part time student for 9 months and paid $1,250 in tuition for 2021. [T2202] 4. Two charitable donation receipts. One in Slim's name for $975 from the Canadian Health Federation dated November 15, 2021. A second receipt in Hemi's name for $125 from CCNB dated December 3, 2021. [Donations] 5. A statement from the Dentist "R" US Dental Clinic that Slim paid a total of $1,450 during 2021. This consisted of $750 for himself on November 23, and $700 for Hemi on December 15. [Medical] 6. A T2202A "Tuition And Enrollment Certificate" for their 18 year old daughter Niece Trim from the University of OFTC (B. Education program). It showed she was a full-time student for 4 months and paid $3,200 in tuition for 2021. Niece had income of $2,500 and has signed the tuition transfer declaration to transfer the maximum amount to her dad. [Tuition transfer] 7. Slim owns a residential rental property at 786 JJJWay Avenue, Scarborough, ON M2W 1Y5. No capital additions or any CCA claims were made since the building's acquisition in 2018. The financial information for the property, for the year ended December 31, 2021, is as follows [T776]: Rental income $18,000 Mortgage interest $4,500 Maintenance and repairs $2,150 Management and administration fees $1,800 Property taxes $3,200 Total expenses $11,650 Net Income before amortization $ 6,350 8. Mr. Slim's mother, Eunice, was born on April 10, 1944, and lives with Mr. Slim and his wife. His mother has some physica infirmity from a stroke and depends on Slim and Hemi for caregiver support She does not qualify fo 1 Prepare the 2021 income tax return for Slim Trim using the ProFile tax software program. Submission Instructions: Submit your assignment on eCentennial under "Assignments-TSC Test". Your submission should include: 1) The entire ProFile computer file (the file extension that ends.21T; for example PKumar.21T), and 2) Save the following completed forms from ProFile in PDF format and submit for marking: T1 Jacket & T1 Summary 1 -Win 2022 Tax Software Computer Test Time Allowed: 72 Hours - Take Home Test Mr. Slim Trim (SIN 527-000-061) is a married, Accountant living in Markham, Ontario. His wife, Mrs. Hemi Trim (SIN 527-000-129) works as a part time school assistant and had total income of $2,800 for 2021. [INFO] Title First Name Last Name They have been your clients for many years. They are currently living at 444 ZZZ-Top Street in Markham, ON L4H 5B9. Their home phone number is (905) 111-1111. [INFO] SIN Date of birth (Y/M/D) Marital Status Canadian Citizen? Provide Information to Elections Canada? Own Foreign Property of More than $100,000 Canadian? Slim brings you the following receipts and documents: 1. T4 slip for Slim (see slip below for details. [T4 slip] SA QUE ME A Mr. Slim -- Trim 527-000-061 HEA ASU 1969-02-28 Yes Married Yes No Mrs. Hemi Trim 527-000-129 1971-04-30 Married Yes C Yes No 2 T5 Statement of Investment Income issued by the bank for their joint account 50% each (see slin below for details [T5 1. T4 slip for Slim (see slip below for details. [T4 slip] 2. T5 Statement of Investment Income issued by the bank for their joint account 50% each (see slip below for details. [T5 slip] 3. A T2202A "Tuition and Enrollment Certificate" for himself from SRED College. It showed he was a part time student for 9 months and paid $1,250 in tuition for 2021. [T2202] 4. Two charitable donation receipts. One in Slim's name for $975 from the Canadian Health Federation dated November 15, 2021. A second receipt in Hemi's name for $125 from CCNB dated December 3, 2021. [Donations] 5. A statement from the Dentist "R" US Dental Clinic that Slim paid a total of $1,450 during 2021. This consisted of $750 for himself on November 23, and $700 for Hemi on December 15. [Medical] 6. A T2202A "Tuition And Enrollment Certificate" for their 18 year old daughter Niece Trim from the University of OFTC (B. Education program). It showed she was a full-time student for 4 months and paid $3,200 in tuition for 2021. Niece had income of $2,500 and has signed the tuition transfer declaration to transfer the maximum amount to her dad. [Tuition transfer] 7. Slim owns a residential rental property at 786 JJJWay Avenue, Scarborough, ON M2W 1Y5. No capital additions or any CCA claims were made since the building's acquisition in 2018. The financial information for the property, for the year ended December 31, 2021, is as follows [T776]: Rental income $18,000 Mortgage interest $4,500 Maintenance and repairs $2,150 Management and administration fees $1,800 Property taxes $3,200 Total expenses $11,650 Net Income before amortization $ 6,350 8. Mr. Slim's mother, Eunice, was born on April 10, 1944, and lives with Mr. Slim and his wife. His mother has some physica infirmity from a stroke and depends on Slim and Hemi for caregiver support She does not qualify fo 1

Step by Step Solution

3.44 Rating (163 Votes )

There are 3 Steps involved in it

SOLUTION Here is the T1 tax return for Slim Trim that I have prepared using the ProFile tax software program The entire ProFile computer file has been saved as SlimTrim21T and submitted under Assignme... View full answer

Get step-by-step solutions from verified subject matter experts