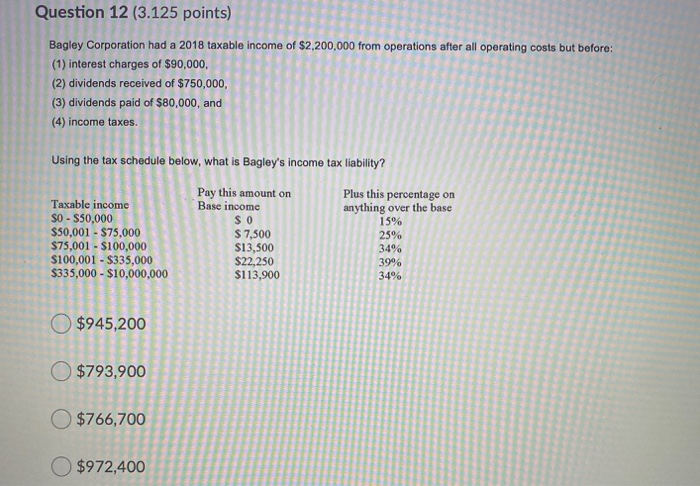

Question: ,000 from operations after all operating costs but before: Question 12 (3.125 points) Bagley Corporation had a 2018 taxable income (1) interest charges of $90,000,

,000 from operations after all operating costs but before: Question 12 (3.125 points) Bagley Corporation had a 2018 taxable income (1) interest charges of $90,000, (2) dividends received of $750,000, (3) dividends paid of $80,000, and (4) income taxes. Using the tax schedule below, what is Bagley's income tax liability? Taxable income SO - $50,000 $50,001 - $75,000 $75,001 - $100,000 $100,001 - $335,000 $335,000 - $10,000,000 Pay this amount on Base income SO $7,500 $13,500 $22,250 $113,900 Plus this peroentage on anything over the base 15% 25% 34% 39% $945,200 $793,900 O $766,700 $972,400

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts