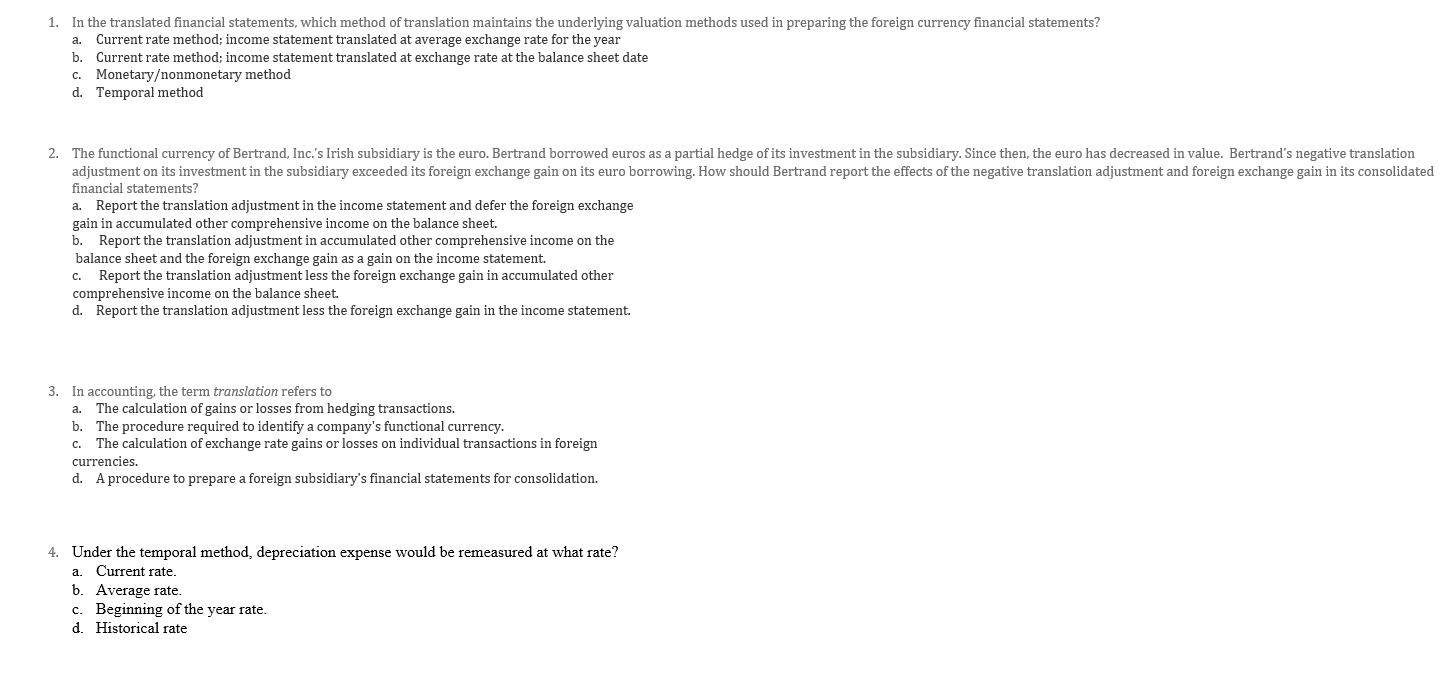

Question: 00.When is remeasurement rather than translation appropriate? How does remeasurement differ from translation? In the translated financial statements, which method of translation maintains the underlying

00.When is remeasurement rather than translation appropriate? How does remeasurement differ from translation?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock