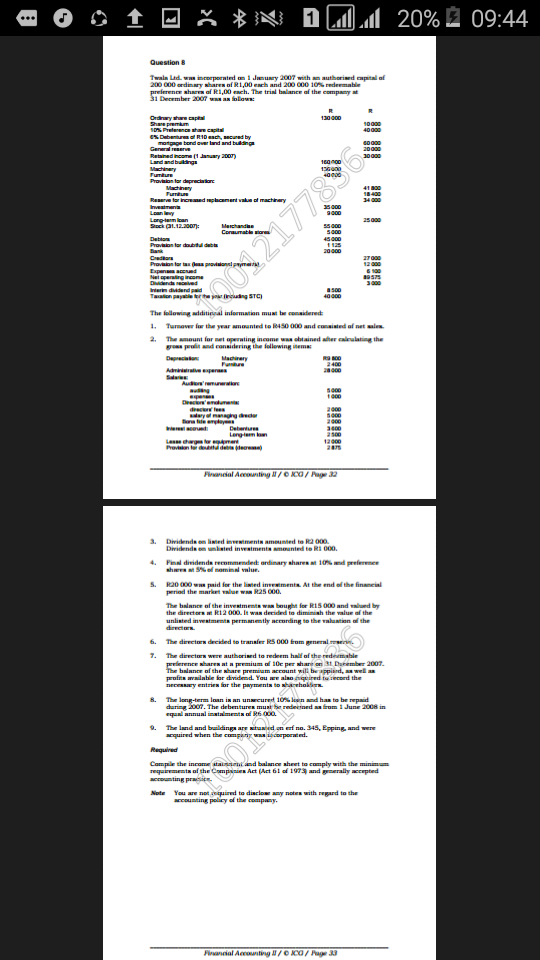

Question: 01 N D Lu 20% 3 09:44 Question 8 Twala lad.ww inceperated on January 2007 with authorised capital of 200 000 ordinary shares of R1,00

01 N D Lu 20% 3 09:44 Question 8 Twala lad.ww inceperated on January 2007 with authorised capital of 200 000 ordinary shares of R1,00 each and 200 000 10% redeemable preference show of R1,00 each. The trial balance of the company 31 December 2007 was follows: Ordinary are capital Sare preko 10%. Penceret e Deberd R10, med by tipa bordover land and building Retained income dary ZO) Landandbunge Tume May Reserve for irodecametake of machinery Lerotic Sack 1.12.2007): Corsurable Provision for 27900 Provision for rent Nel pering income 1955 Where didende 10000 The following aditional information must be considered 1. Tumewer for the year mounted to 10450 000 and consisted of at le 2. The amount format perating income was stained after allting the gross prodit and considering the following item Depreciation Machinery Draconendum directores wayanaging di er fer 5000 2000 3600 2.500 Law 2015 Pranda Accounting / XCO / Pug 12 3. Dividends online and to Ra 000. Dividende en wind investment intend to R1 000. 4. Final dividende remmende ordinary shares and preference shodami lue. 5. R20 000 ww paid for the lined immenta. At the end of the final period the market value R25000. The balance of the investments was bought for RIS 000 and led by the directors R12 000. It was decided to diminish the value of the unlisted investments permanently securding to the valuation of the 6. The directe decided to transfer RS 000 from general 1. The directes were thorised to redeem hall of the redemble preference shares at premium of 10 per what Dember 2007 The balance of the share premium account will be appard, a well profits wilable for dividend. You we also med terecord the THERE entries for the payment to sharehok. 8. The long-term loan is an unsecured 10%.lound has to be repaid during 2007. The debentures must be redeemned from 1 June 2008 in equal annual ini memilR6 000 9. The land and buildings are situs on el no. 345, Epping and were acquired when the com 1 Corporated Required Campoe the income stairied balance sheet to comply with the minin requirements of the Companies Act ( 61 of 1973 and generally accepted Bring Note You are not required to disclose any notes with regard to the accounting policy of the company. Financial Accounting / 0.0 / Page 33 01 N D Lu 20% 3 09:44 Question 8 Twala lad.ww inceperated on January 2007 with authorised capital of 200 000 ordinary shares of R1,00 each and 200 000 10% redeemable preference show of R1,00 each. The trial balance of the company 31 December 2007 was follows: Ordinary are capital Sare preko 10%. Penceret e Deberd R10, med by tipa bordover land and building Retained income dary ZO) Landandbunge Tume May Reserve for irodecametake of machinery Lerotic Sack 1.12.2007): Corsurable Provision for 27900 Provision for rent Nel pering income 1955 Where didende 10000 The following aditional information must be considered 1. Tumewer for the year mounted to 10450 000 and consisted of at le 2. The amount format perating income was stained after allting the gross prodit and considering the following item Depreciation Machinery Draconendum directores wayanaging di er fer 5000 2000 3600 2.500 Law 2015 Pranda Accounting / XCO / Pug 12 3. Dividends online and to Ra 000. Dividende en wind investment intend to R1 000. 4. Final dividende remmende ordinary shares and preference shodami lue. 5. R20 000 ww paid for the lined immenta. At the end of the final period the market value R25000. The balance of the investments was bought for RIS 000 and led by the directors R12 000. It was decided to diminish the value of the unlisted investments permanently securding to the valuation of the 6. The directe decided to transfer RS 000 from general 1. The directes were thorised to redeem hall of the redemble preference shares at premium of 10 per what Dember 2007 The balance of the share premium account will be appard, a well profits wilable for dividend. You we also med terecord the THERE entries for the payment to sharehok. 8. The long-term loan is an unsecured 10%.lound has to be repaid during 2007. The debentures must be redeemned from 1 June 2008 in equal annual ini memilR6 000 9. The land and buildings are situs on el no. 345, Epping and were acquired when the com 1 Corporated Required Campoe the income stairied balance sheet to comply with the minin requirements of the Companies Act ( 61 of 1973 and generally accepted Bring Note You are not required to disclose any notes with regard to the accounting policy of the company. Financial Accounting / 0.0 / Page 33

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts