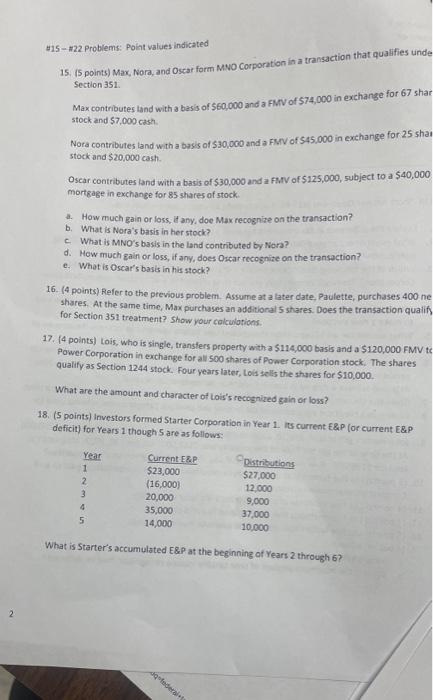

Question: 015 - #22 Problems: Point values indicated 15. (5 points) Max, Nora, and Oscar form MNO Corporation in a transaction that qualifies unde Section 351

015 - #22 Problems: Point values indicated 15. (5 points) Max, Nora, and Oscar form MNO Corporation in a transaction that qualifies unde Section 351 Max contributes land with a besis of $60,000 and a FMV of 574,000 in exchange for 67 shar stock and $7,000 cash Nora contributes tand with a basis of 530,000 and a FMV of $45.000 in exchange for 25 shai a stock and $20,000 cash. Oscar contributes tand with a basis of 530,000 and a FMV of $125,000, subject to a $40,000 mortgage in exchange for 85 shares of stock How much eain or loss, it any, doe Max recognise on the transaction? b. What is Nora's basis in her stock? What is MNO's basis in the land contributed by Nora? d. How much gain or loss, if any, does Oscar recognize on the transaction? e. What is Oscar's basis in his stock? 16. (4 points) Refer to the previous problem. Assume at a later date, Paulette, purchases 400 ne shares . At the same time, Max purchases an additional 5 shares. Does the transaction qualify for Section 351 treatment? Show your calculations 17. (4 points) Lois, who is single, transfers property with a $114,000 basis and a $120,000 FMV t- Power Corporation in exchange for all 500 shares of Power Corporation stock. The shares qualify as Section 1244 stock. Four years later, Lois sells the shares for $10,000 What are the amount and character of Lois's recognized gain or loss? 18. (5 points) Investors formed Starter Corporation in Year 1. is current E&P (or current E&P deficit) for Years 1 though 5 are as follows: Year 1 2 3 4 5 Current EXP $23,000 (16,000) 20,000 35,000 14,000 Distributions $27,000 12.000 9,000 37,000 10.000 What is Starter's accumulated E&P at the beginning of Years through 67 2 federal 015 - #22 Problems: Point values indicated 15. (5 points) Max, Nora, and Oscar form MNO Corporation in a transaction that qualifies unde Section 351 Max contributes land with a besis of $60,000 and a FMV of 574,000 in exchange for 67 shar stock and $7,000 cash Nora contributes tand with a basis of 530,000 and a FMV of $45.000 in exchange for 25 shai a stock and $20,000 cash. Oscar contributes tand with a basis of 530,000 and a FMV of $125,000, subject to a $40,000 mortgage in exchange for 85 shares of stock How much eain or loss, it any, doe Max recognise on the transaction? b. What is Nora's basis in her stock? What is MNO's basis in the land contributed by Nora? d. How much gain or loss, if any, does Oscar recognize on the transaction? e. What is Oscar's basis in his stock? 16. (4 points) Refer to the previous problem. Assume at a later date, Paulette, purchases 400 ne shares . At the same time, Max purchases an additional 5 shares. Does the transaction qualify for Section 351 treatment? Show your calculations 17. (4 points) Lois, who is single, transfers property with a $114,000 basis and a $120,000 FMV t- Power Corporation in exchange for all 500 shares of Power Corporation stock. The shares qualify as Section 1244 stock. Four years later, Lois sells the shares for $10,000 What are the amount and character of Lois's recognized gain or loss? 18. (5 points) Investors formed Starter Corporation in Year 1. is current E&P (or current E&P deficit) for Years 1 though 5 are as follows: Year 1 2 3 4 5 Current EXP $23,000 (16,000) 20,000 35,000 14,000 Distributions $27,000 12.000 9,000 37,000 10.000 What is Starter's accumulated E&P at the beginning of Years through 67 2 federal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts