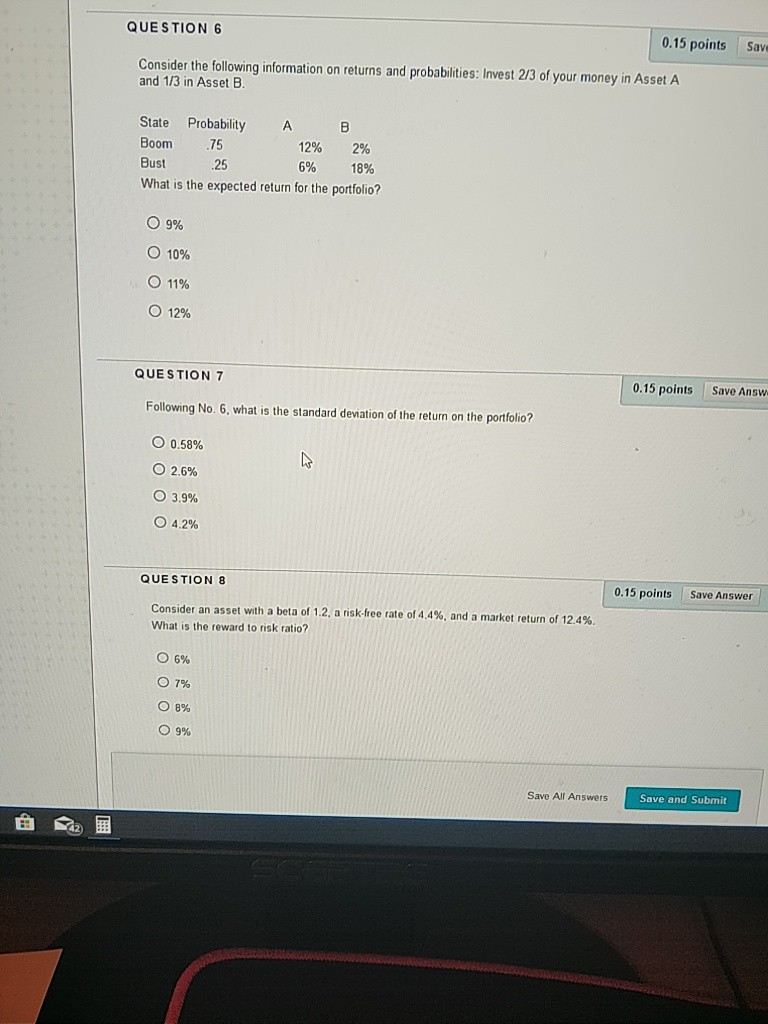

Question: 0.15 points Save QUESTION6 Consider the following information on returns and probabilities: Invest 2/3 of your money in Asset A and 1/3 in Asset B.

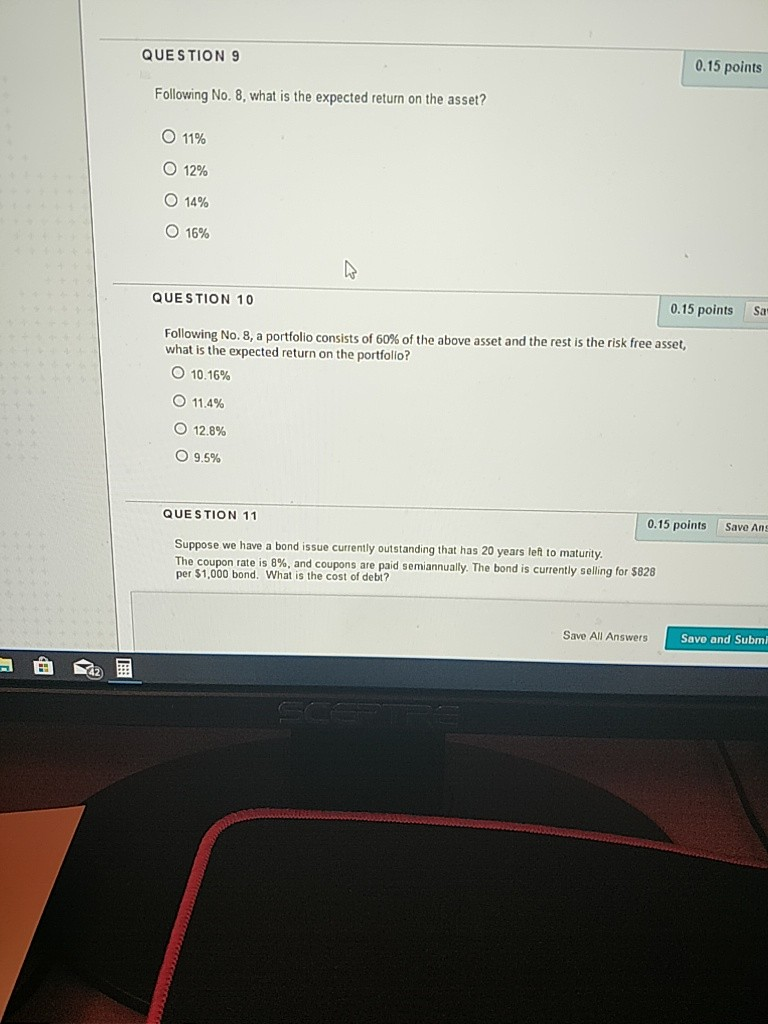

0.15 points Save QUESTION6 Consider the following information on returns and probabilities: Invest 2/3 of your money in Asset A and 1/3 in Asset B. State Probability A B Boom 75 Bust What is the expected return for the portfolio? 12% 6% 2% 18% .25 09% O 10% o 11% 12% 0.15 points Save Answ QUESTION 7 Following No. 6, what is the standard deviation of the return on the portfolio? 0 0.58% O 26% 3.9% 42% 0.15 points Save Answer QUESTION 8 Consider an asset with a beta of 1.2, a risk free rate of 4.4%, and a market return of 124%, What is the reward to risk ratio? o 6% o 7% o 8% o 9% Save All Answers Save and Submit 0.15 points QUESTION 9 Following No. 8, what is the expected return on the asset? O 11% 1296 14% 16% 0.15 points Sa QUESTION 10 Following No. 8, a portfolio consists of 60% of the above asset and the rest is the risk free asset, what is the expected return on the portfolio? 10.16% o 11.4% 12.8% o 9.5% 0.15 points Save Ans QUESTION 11 Suppose we have a bond issue currently outstanding that has 20 years lef to maturity. The coupon rate is 8%, and coupons are paid semiannually. The bond is currently selling fo per $1,000 bond. What is the cost of debt? Save All Answers Save and Submi

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts