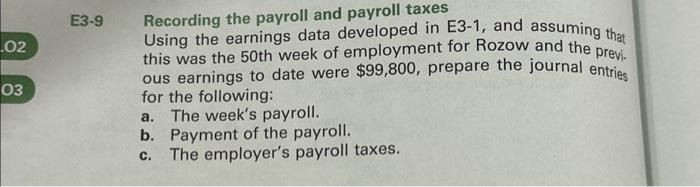

Question: 02 03 E3-9 Recording the payroll and payroll taxes Using the earnings data developed in E3-1, and assuming that this was the 50th week of

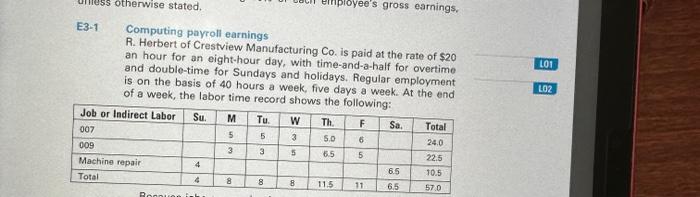

Recording the payroll and payroll taxes Using the earnings data developed in E3-1, and assuming that this was the 50th week of employment for Rozow and the previ. ous earnings to date were $99,800, prepare the journal entries for the following: a. The week's payroll. b. Payment of the payroll. c. The employer's payroll taxes. 1 Computing payroll earnings R. Herbert of Crestview Manufacturing C0. is paid at the rate of $20 an hour for an eight-hour day, with time-and-a-half for overtime and double-time for Sundays and holidays. Regular employment is on the basis of 40 hours a week, five days a week. At the end of a week, the labor time record shows the fallowin

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts